The last mile is crucial

If one sector has experienced a significant boost from the pandemic and the accompanying digitalisation, it’s e-commerce. During the last two years, we have seen the demand for online consumption strongly accelerating and fast (or even instant) delivery becoming an integral part of the online shopping experience. This development is putting last mile logistics under tension but also sparks new opportunities for innovation. At Burda Principal Investments (BPI), we have always been very active in the e-commerce space – backing the growth phases of companies like Etsy, Vinted and Bloom&Wild. No surprise, that we have also been monitoring the last mile closely, analysing consumer expectations, evaluating trends along the value chain, and also making investments into vertically integrated last mile companies, such as Zapp or arive.

e-Commerce: increasing demand and rising consumer expectations

As the COVID-19 pandemic forced brick-and-mortar retailers to shut their doors and sent consumers onto their sofas, the transition of consumption from offline to online accelerated substantially, even in previously offline-dominated verticals. With Shopify & co offering easy-to-create web shops it has become child’s play for retailers and brands to set up their own online shops. Overall, this development has led to a growth of 49% in global e-commerce sales during the Covid years, increasing from $3.6t in 2019 to $4.9t in 2021 and there are no signs of a reversal of this development.

At the same time, Amazon Prime and the emergence of new superfast delivery players – e.g. GoPuff, Zapp and Flink, to only name a few – have started to provide service levels that have influenced the consumers’ expectations regarding the e-commerce delivery experience. Expectations moved from multi-day to same-day (and even near-instant in urban areas). More than 30% of customers abandon their carts because of subpar delivery times offered by online retailers.

However, fast delivery is not the only requirement online shops have to fulfil. Consumers demand control and transparency along the last mile. This includes the possibility to track the status of the delivery at any given point in time and the ability to make last-minute changes to their orders or delivery preferences. This not only avoids the cost and inconvenience associated with failed deliveries but also reduces their environmental impact. Driven by the ever-increasing demand for e-commerce delivery, the World Economic Forum forecasts 36% more delivery vehicles in the world’s top 100 cities by 2030, entailing increased emissions and traffic jams.

Not only the sustainability of last mile delivery but also the availability of local brands and products are becoming more important factors for consumers, posing yet another challenge (and opportunity) for the last mile value chain.

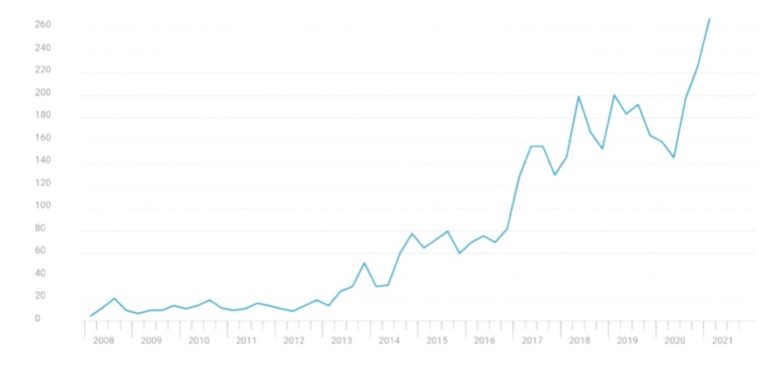

Mentions of “last mile” in corporate earnings calls – Last Mile is increasingly becoming a cocnern for businesses, CB Insights

Fundamental issues along the last mile

While the e-commerce market has evolved rapidly over the last years, innovations in the e-commerce delivery value chain – which is dominated by a small number of large incumbents – remained low. Correspondingly, customer satisfaction increasingly suffers as e-commerce becomes ubiquitous and consumer expectations increase (view above). Trustpilot scores of DHL, DPD, UPS, and Hermes are at an average of 1.5 out of 5. One in five UK online shoppers experience a delivery problem on a weekly basis.

At the same time, last mile delivery severely suffers under inefficiencies (failed deliveries, low drop sizes etc.), high cost (the last mile comprises >50% of the overall shipping cost in e-commerce) and negative environmental impact, as described above.

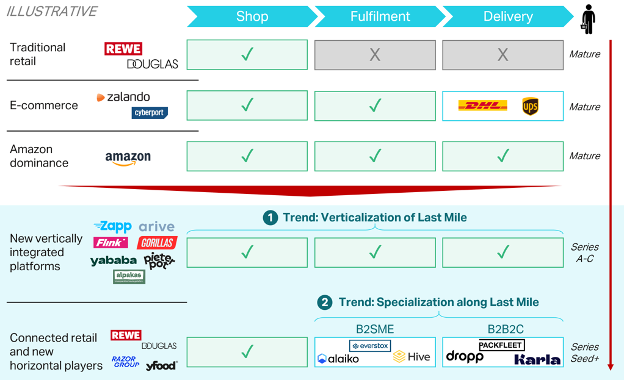

Traditional Value Chain

Innovation is driven by new players

Over the past years, an array of entrepreneurs across the globe have spotted the divergence described above and have brought about a broad range of solutions to tackle the issues along the last mile. These solutions range from hardware, over enterprise software to consumer platforms. This is, of course, an exciting development for VCs and according to Pitchbook, global VC funding in supply chain technology has exceeded €54b in 2021 which adds up to more than 50% of growth compared to 2020. A large proportion of the funding flowed into companies active along the last mile.

Within this ecosystem, we at Burda Principal Investments are particularly focused on two broader trends which we want to take a closer look at in the following.

Trend 1: Vertical integration (or the emergence of new B2C retail companies)

This trend refers to e-commerce companies that are vertically integrating along the last mile value chain. Examples are Flink, Zapp and arive that own the entire last mile operation and are enabled to provide faster delivery and keep increased control over their operations. The last two mentioned are part of our portfolio. Zapp is a full-stack convenience delivery business that builds the logistical infrastructure to deliver thousands of on-demand convenience and grocery items to customers within minutes. While they deliver from the neighbourhood stores directly to the customers, arive delivers a carefully curated assortment of lifestyle products from both their own warehouses as well as directly from the brands’ offline retail stores within a two-hour window. With its approach, arive represents a group of vertically integrated players that leverages the advantages of focusing on specific verticals. Next to the near-instant delivery, which is becoming the next normal on the demand side, top tier brands are searching for brand-safe platforms that enable them to bring their exclusive offline experience online. Other examples with a vertical focus are Yababa targeting Turkish and Arabic communities, HungryPanda, also a BPI portfolio company targeting Chinese eaters or Pieter Pot and Alpakas, offering plastic-free grocery delivery and thereby reducing the environmental impact.

Trend 2: Specialization within the value chain (or the emergence of new B2B companies)

A growing number of start-ups have emerged to tackle inefficiencies along the last mile and to enable the broader e-commerce market to keep up with Amazon when it comes to fulfilment and delivery service levels. These include new types of delivery companies, such as Packfleet, Dropp or Liefergruen, that offer online retailers next-day, same-day or even near-instant delivery. A BPI investment in this area is Ninja Van, a last mile delivery platform for SME e-commerce that manages more than 1 million parcel deliveries on an everyday basis – based on their complex, hard-to-replicate logistics network across more than six core Southeast Asian countries. Another set of companies aim at providing the entire fulfilment operations incl. storage, packaging, dispatching and return management through both own and rented warehouse capacity thereby also competing with Amazon logistics. While companies like Everstox, Warehousing1 or Hive are focused rather on smaller D2C brands and SME retailers, Spacefill is a company in this space focused on large enterprise clients. Lastly, other companies hone in on specific parts of this value chain: Some companies, for example, focus on enhancing transparency and control over last mile delivery for consumers – an approach ParcelLab or Karla Delivery take, and which attracts high profile investors.

Retail Value Chain Developments

A fragmented market with a lot of opportunities

All these developments explained above result in the value chain being disrupted, dominant players, including Amazon, being challenged and the market getting more and more fragmented. We do believe that the consolidation of these new players will again happen over time. However, from our perspective, all the developments in the retail space have an overall positive impact on the competitive landscape. In the end, consumer demands will be met in a better way, as the consolidation will also lead to an improvement regarding the quality and the sustainability of the delivery. As access to financing in the current market environment (rising interest rates, macroeconomic uncertainty, high inflation rates etc.) is becoming more of a challenge – especially for the more capital-intensive models mentioned above – the velocity of disruption in this space might be at a slower pace while a potential market consolidation may well be accelerated.

At BPI, we have always invested in unbundling and verticalization of the e-commerce world – thinking of early investments in Etsy and Vinted – and with recent investments we are already active in the trends within near-instant delivery described above. Nevertheless, we believe that the disruption in the last mile is only getting started and we are looking forward to meeting the up-and-coming founders within this space soon.

If you have an interesting business model in this space, reach out to us at investments@burda.com!