Exploring the Current Traction of Generative AI: Separating Hype from Reality in Developer Traction, Consumer Excitement, Prosumer Adoption, and Enterprise Interest

This is the second part of our series “Third Wave” – BPI Perspectives on Generative AI, if you missed the first part, access it here.

In this chapter of our BPI Perspectives on Generative AI series, we try to gauge whether the current Generative AI wave is just a temporary hype or whether there are signals that point towards it indeed being a fundamental platform shift. Due to the early stage of the space, which is still being created, we are focusing mostly on the builders’ side, while only briefly evaluating first signals of consumer adoption.

Broadly speaking, AI-enabled companies have – according to Pitchbook – received more than $200bn of VC funding over the past 3 years and are already creating undeniably meaningful impact across industries. For instance, the number of drugs developed in clinical trials using an AI-first approach grew from 0 in 2020 to 18 in 2022. While AI/ML has so far been primarily used to make predictions, Generative AI is used to create content (Code, Text, Images etc.).

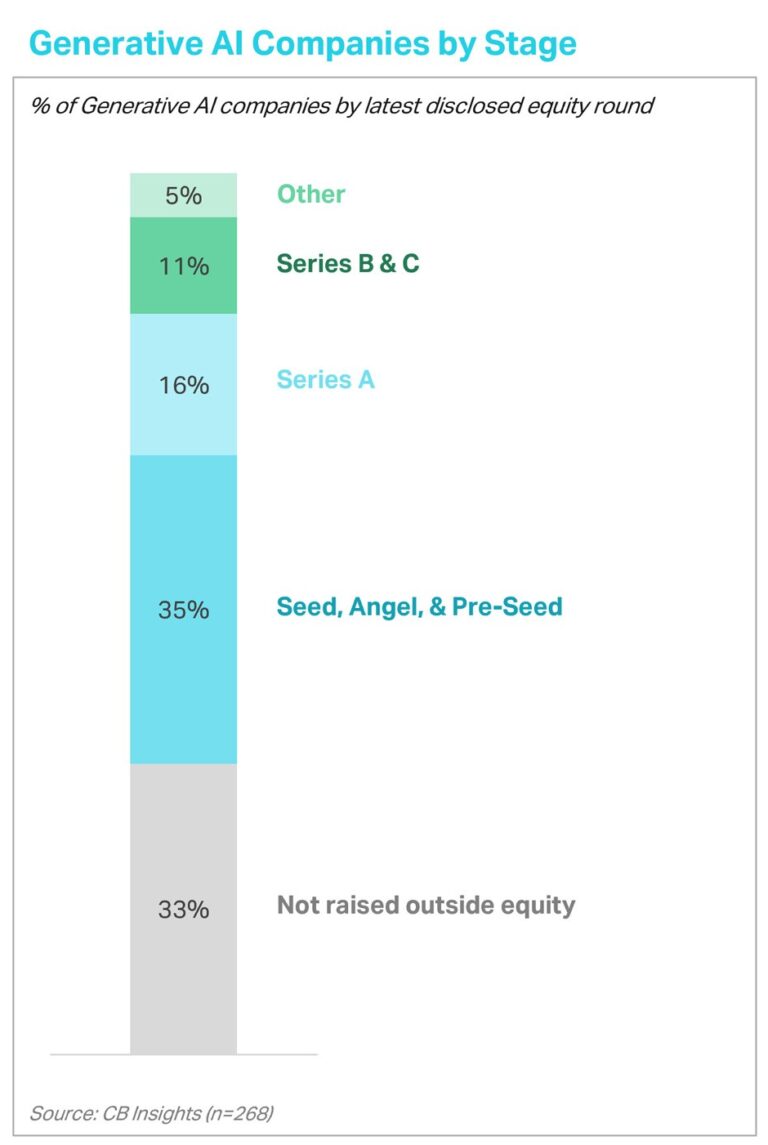

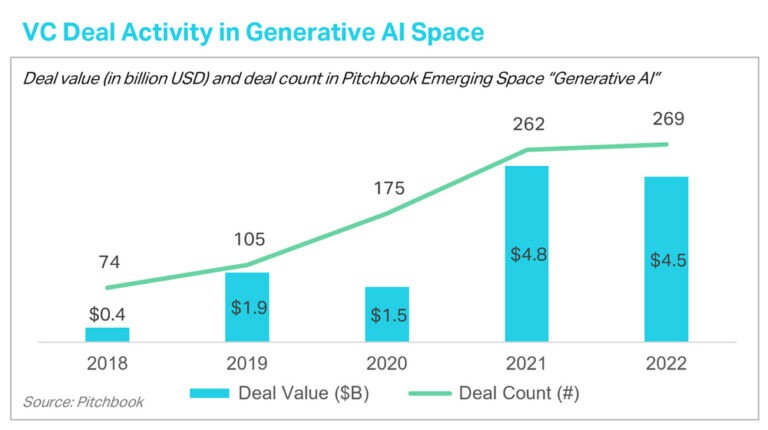

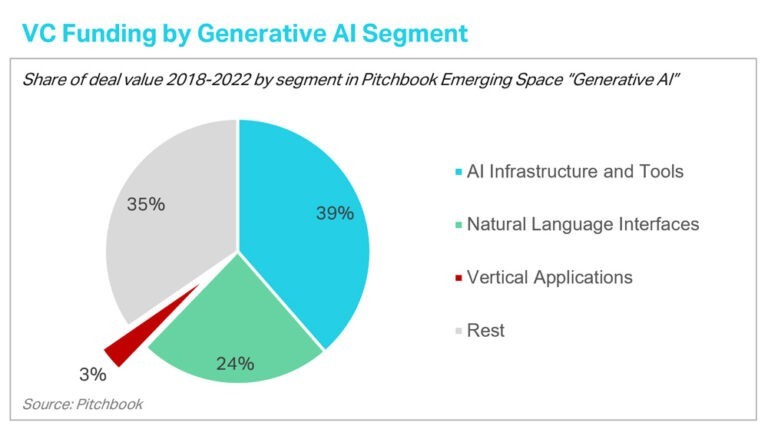

The subsegment Generative AI is still in a nascent state when it comes to start-up maturity, but the space is now gaining momentum (refer to Part I to learn more about the underlying drivers). According to Pitchbook, venture funding in the space has significantly picked up in recent years, with $4.8 billion across 262 deals and $4.5 billion across 269 deals invested in 2021 and 2022, respectively. However, we believe there is still a lot more to come in the coming months and years. According to CB Insights, 35% of Generative AI start-ups are still in Seed or Pre-Seed stage, while 33% have not raised any outside equity yet. Additionally, most of investment this far has gone into Generative AI Infrastructure and Tools, which are now providing a platform for new innovations on the (vertical) applications layer, for example in the LegalTech or HealthTech space.

Figure 1 – Generative AI VC Activity, Source: CB Insights and Pitchbook

(as of 31st December 2022).

One signal that provides us with confidence that we will see the described wave of innovation emerging on top of this new platform is developer traction in the context of foundation models. But also interest from Consumer, Prosumers and Enterprises point up and to the right.

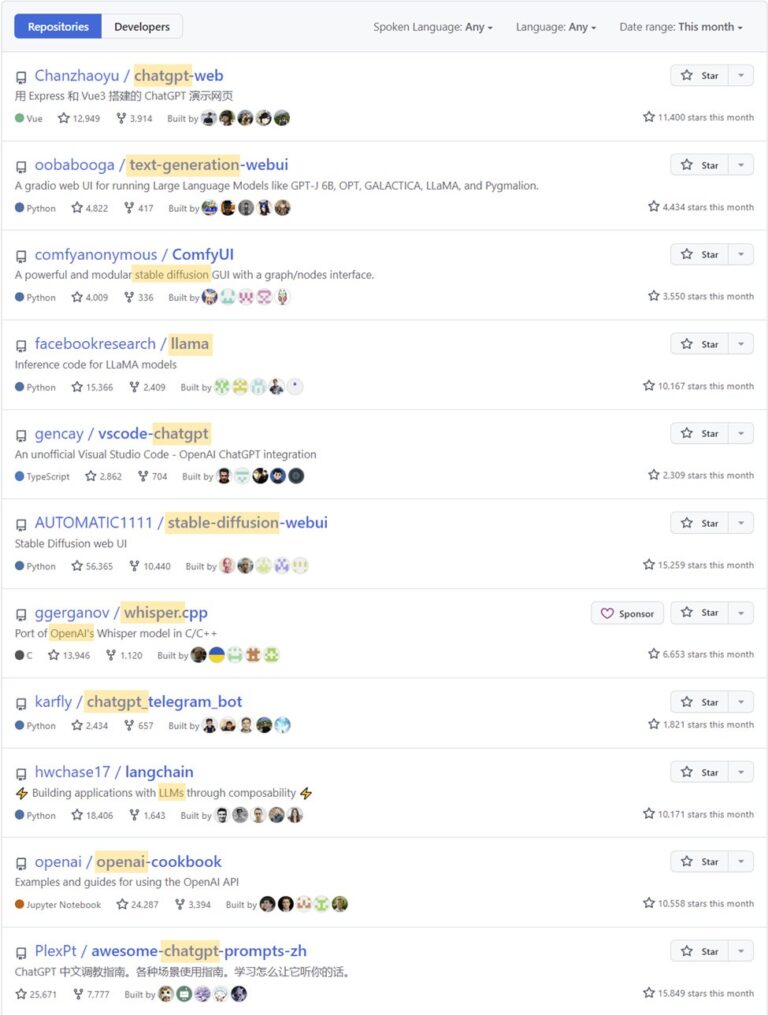

Developer Traction: Stable Diffusion saw the fastest developer uptake ever among open-source software infrastructure, including Ethereum. In recent months, it has been difficult to find a single trending repository on GitHub that is not associated to one of the large foundation models (view figure 2 for March’s trend chart). While these signals are obviously also driven by the broader hype, it is undeniable that builders are extremely excited about the possibilities of Generative AI foundation models. They are using them to experiment with different use cases and are building new applications on top of the new AI platform.

Figure 2 – GitHub Trending Top Trending Repositories in March 2023

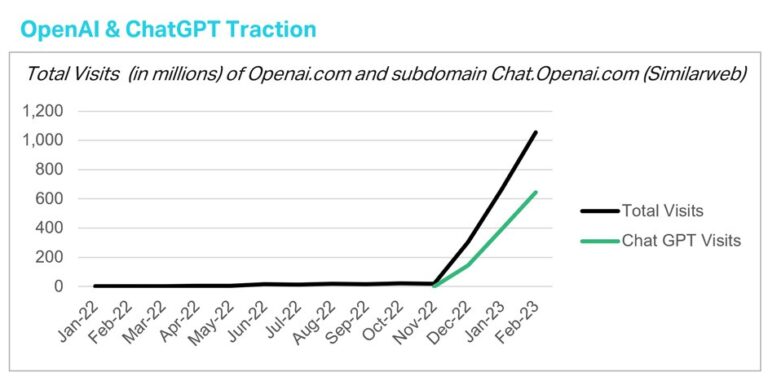

Consumer Excitement: The broader public got incredibly fascinated by the capabilities and utility of readily available tools, like Open AI’s Chat GPT, which reached 1 million users only 5 days after launching. According to Similarweb, the OpenAI website, which encompasses the ChatGPT web application, was visited by a whopping 197 million users in December 2022. That is almost 2x the number of verified Coinbase users in 2022, if one wishes to draw a comparison to Web3 traction.

Figure 3 – OpenAI Web Traffic, Source: Similarweb

Prosumer Adoption: GitHub Copilot, a Generative AI tool that autocompletes code for programmers, accumulated 400 thousand subscriptions only one week after its launch in June 2022. As of February 2023, GitHub Copilot is behind an average of 46% of developers’ code on GitHub across all programming languages. At some point, the waitlist for Notion AI reached ca. 2 million.

Enterprise Interest: Without a doubt, Generative AI is a conversation topic on every executive floor across industries and geographies since Chat GPT. Foundation model providers, like Aleph Alpha, are seeing unprecedented inbound interest from corporations that want to capitalize on the promises of Generative AI, be it productivity gains or new product creation.

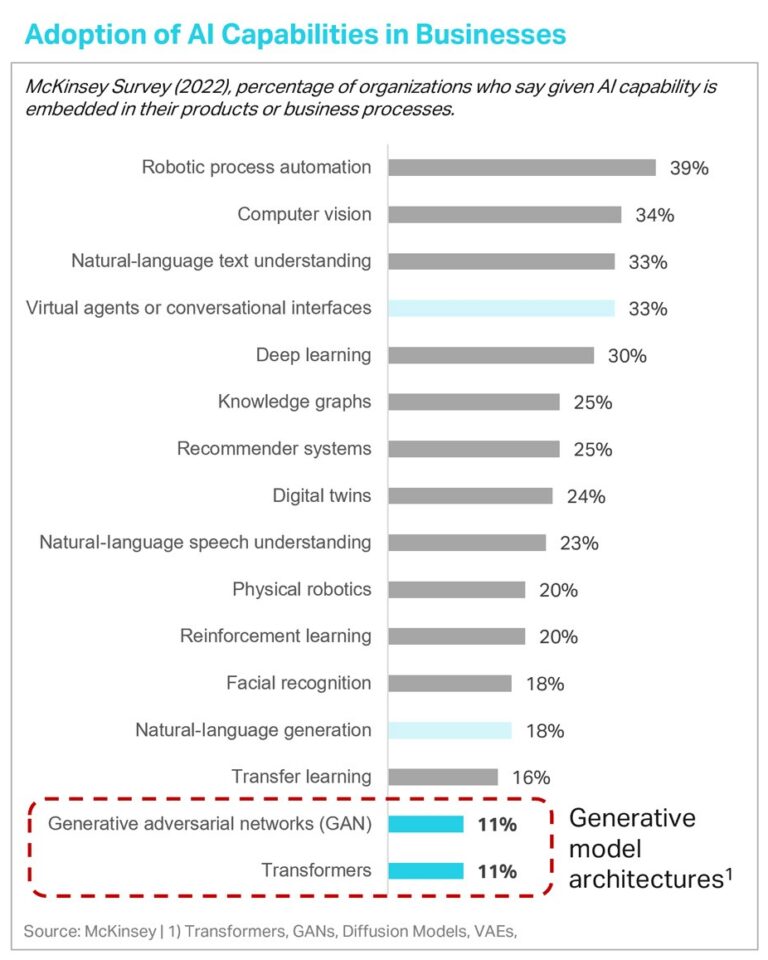

McKinsey’s most recent “State of AI” report suggests that 11% of surveyed organizations embed a Generative AI model architecture (e.g. Transformers) in at least one of their products or processes. While this might seem low compared to other AI capabilities on the list (view Figure 4), keep in mind that these fundamental technologies only emerged recently. Transformers, for example, were only incepted in 2017 by Google researchers.

In their Webinar “Generative AI: From Macro to Micro and the Path Forward”, Goldman Sachs predicted on March 31st that new Generative AI models will provide an annual labour productivity boost of 1.5 percentage points in the US market and increase global GDP by 7% over the next 10 years.

Figure 4 – “State of AI 2022”, Source: McKinsey

While all these signals point towards Generative AI being an actual platform shift, instead of only a short-term hype, we are well aware of its early stages. Foundation models are still in their infancy. Computing power remains a fundamental bottleneck to broad-based and economically sustainable adoption of Generative AI applications. Nevertheless, we remain extremely excited about the space and look forward to the new products and innovations emerging on top of the “Third Wave”.

In the next installment of this BPI perspectives series, we are sharing some of our thoughts about where in the Generative AI value chain, defendable economic value might accrue in the long term.