Exploring the Fundamentals of Generative AI: Part One of Our Four-Part Series on the Platform Shift Reshaping the Future

“If we had to drink a shot every time ‘Chat GPT’ was mentioned at this conference, we would all have been dead within the first hour” – Ina Fried’s opening line to her panel on generative artificial intelligence (AI) during this year’s DLD conference perfectly summarizes the current hype around this topic. Did you know? At the same conference, a panel on the opportunities of Generative AI for the European start-up ecosystem was hosted by Burda Principal Investments (BPI) CEO Christian Teichmann. See video here.

Just in the few weeks since DLD, countless breath-taking announcements, product demos, and releases have come out of this space (Microsoft’s investment in OpenAI, the AWS and Hugginface partnership, Google’s investment in Anthropic, the release of GPT-4, third-party plug-ins for ChatGPT etc.). Only one quarter into 2023 and Generative AI is not only set to be the technology hype of the year, but of the decade. But is this hype justified? What should investors and entrepreneurs look out for in the coming months? What is the perspective of BPI as an early growth investor on this topic? Over 4 brief episodes of our perspectives blog, we want to share some of our thinking with you in the coming weeks.

In 2018, BPI began to conduct deeper research into AI as an enabling technology to sharpen our investment theses in product-led platform and marketplace investments (e.g. Vinted, Nord Security, Bloom & Wild). We have developed the belief that AI will trigger the third major wave of 21st century digital tech innovation after the internet and cloud computing. So far, we have viewed AI as a horizontal technology and as an “enhancer” for various existing use cases across industries and verticals. While this largely remains true, after the emergence of the current generation of ground-breaking AI models, we also started to be highly interested in completely new standalone products emerging off the back of the new platform shift, aka the “Third Wave”. But let’s take a step back and start with the “basics” of AI.

While AI is a broad term that refers to software or hardware exhibiting behaviours, which appear intelligent, modern AI is mostly focused on a set of techniques called Machine Learning (ML), which enable software programs to learn through training, instead of being explicitly programmed with rules. Recently, a wave of new models – primarily Transformer and Diffusion models – propelled the space onto a new level of performance, including new Generative AI models: “AI technologies or applications that generate original content”. They enable machines to produce text, code, or conduct other creative tasks. One highly exciting feature of these newer models is their flexibility. While earlier generations of AI systems were mostly good for one specific purpose, newer models can be reassigned from one type of problem to another, closing in on Artificial General Intelligence (AGI). These models are also called “Foundation Models” and promise huge economic potential as general-purpose technologies. A research paper by OpenAI, OpenResearch, and the University of Pennsylvania, published in March 2023, suggests that approximately 80% of the US workforce could have at least 10% of their work tasks affected by the introduction of generative transformer models. This underlines the breadth of applicability of the current wave of AI models, a key ingredient for becoming a new major platform technology. The Economist even drew the comparison between foundation models and printing presses, steam engines, and electric motors.

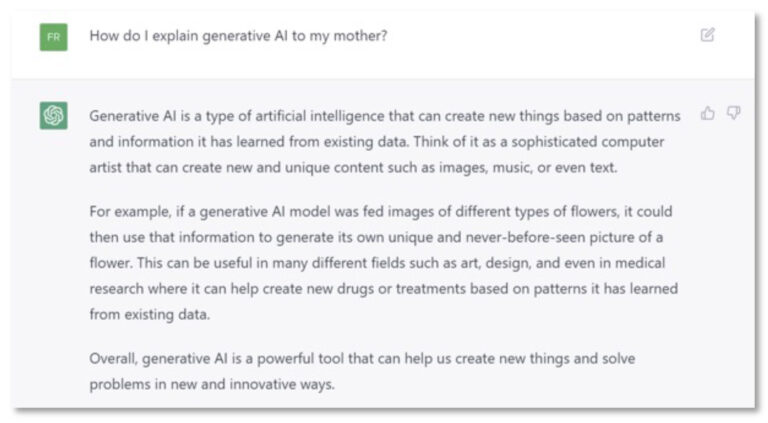

Chat GPT explaining Generative AI to my mother.

We are at the beginning of the Generative AI journey and foundation models are still in their infancy. The question of how this new platform will look like and who its gatekeepers will be cannot answered yet. However, we can outline two observations we have made thus far:

1. Decentralization vs. centralization, there are currently two diverging trends (or future scenarios) emerging: on the one hand, large closed-source and generalizable foundation models are built by well-funded companies, such as OpenAI or Cohere. These companies are often backed by BigTech, such as Microsoft or Google. Due to the large capital, talent, and data requirements of creating and training large foundation models, it is believed that there might only be a few dominant Generative AI platforms in the future, on top of which specialized AI applications will be built. On the other hand, there are already strong pretrained open-source models (e.g. BLOOM) available for entrepreneurs and engineers to use as basic infrastructure to develop and finetune their own – more focused – models. These models would be tailored for a specific vertical or particular use case (e.g. new drug design for pharma). In this scenario, there would be a multitude of different and more specialized model providers.

Perhaps the most likely future scenario will be a hybrid structure, where there are a few large providers of the very fundamental and most capital-intensive infrastructure (akin to hyperscalers in the cloud computing market), but due to lower end-user network effects compared to e.g. social media, there is still space to build purpose-tailored generative models and successful business along the entire AI value chain.

2. Geographical split: most large foundation models are coming out of the US (approx. 63%) and China (35%). However, in the EU, Aleph Alpha has also managed to develop a multimodal foundation model that can keep up with the competition and is tailored towards EU enterprise use cases. Most experts expect there to only be a few large foundation model providers globally, but at least one from each: the US, Europe, and China – due to geopolitical importance of this layer and regulatory hurdles.

We will further discuss the foundation model layer in Part III of this blog series, where we explore the value-creation and potential for defendable businesses along the Generative AI value chain.

AI is not a new topic and there has been a lot of talk about this area of technology for years, but the recent developments in Generative AI have sparked a new wave of excitement, innovation, and funding. The quality and capabilities of generative models for the creation of text, image, audio, and video content has shown tremendous advances in 2022. Global VC investment in Generative AI start-ups increased about 70% YoY in 2022, while total venture funding marked a 35% drop YoY. In Q4 2022 alone, we saw the record-breaking release of ChatGPT – the fastest growing digital consumer application of all time – and the birth of two new Generative AI Unicorns (Jasper and Stability).

During such a hype, it is crucial to remain disciplined as an investor, especially at the later stage and in the context of broader economic uncertainty. To that end, we are currently working on three questions:

- Is this platform shift already gaining sustainable traction or is it all hype?

- Where along the Generative AI value chain will defendable value accrue?

- What are the most lucrative verticals and use cases in the Generative AI space?

In the next instalments of BPI perspectives, we’ll dive deeper in each of these questions to share some of our thinking with you. Stay tuned for parts II, III and IV of this series!