Embracing AI’s Impact on LegalTech

This article was written in collaboration between Burda Principal Investments and UnternehmerTUM’s Legal Tech Colab.

A space mature for disruption

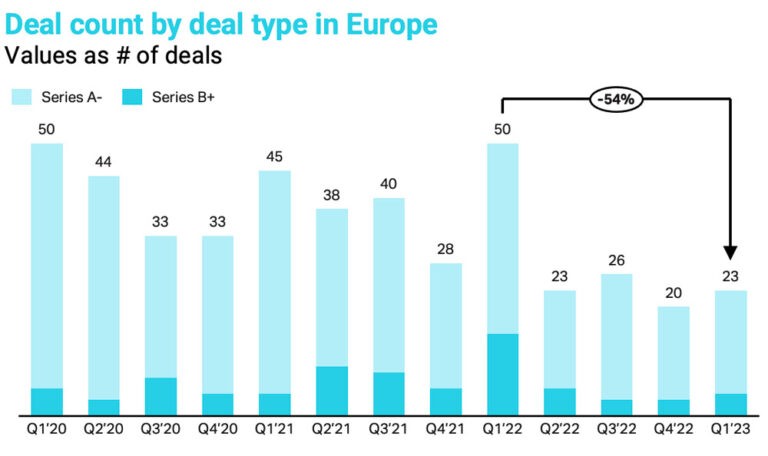

Looking at the trajectory of VC investments in the LegalTech space (Figure 1), it becomes evident that the sector experienced a notable surge of interest in 2021, followed by a subsequent decline similar to the fluctuations observed in the adjacent Fintech space.

Figure 1 – ‘LegalTech’ VC investments evolution in Europe

Source: Pitchbook (2023), BPI analysis

However, we maintain an enthusiastic outlook on LegalTech, recognizing the domain as an exciting investment opportunity. In the upcoming sections of this blog post, we will delve into the customer segments that can be targeted by LegalTech; subsequently, we will elaborate on the rationale behind our excitement, mostly driven by three factors:

- Customer’s uptake: we witness significant traction in the adoption of technology by law firms and enterprises’ legal departments, driven by a macroeconomic landscape forcing these players to seek efficiency enhancements, with a huge value creation potential given the current baseline of little to no digitization.

- Re-bundling: we see a trend towards consolidation of a fragmented stack, driven by customers becoming more sophisticated buyers and recognizing the value that unified platforms can bring – this presents an opportunity for software providers to offer all-in-one solution with higher stickiness and average contract value.

- GenAI disruption: we witness an emerging wave of innovation in the technology stack, where generative artificial intelligence (GenAI) plays a central role. This wave already demonstrated remarkable potential, while not having even scratched the surface of what is fully achievable.

We believe that these combined factors paint a promising picture for the future of LegalTech.

The customer: Four segments, each with their appeal and limitations

We have identified four customer segments for LegalTech solutions: law firms, enterprises of all sizes, the public sector, and consumers.

- Law firms are the epitome of legal service providers par excellence. We differentiate between large law firms (more than 100 professionals) and small and medium sized law firms (less than 100 professionals; hereinafter: “SMF”).

- Enterprises encounters legal challenges in various areas including regulations and compliance, contracts with suppliers and customers, company agreements and board resolutions. While they may have their own legal departments, they also rely heavily on externally provided legal services. In the following, we again distinguish between SMEs and large enterprises.

- The public sector encompasses all governmental institutions, and is a provider and recipients of legal services across different departments and levels of government, often engaging law firms or other authorities in the process.

- Consumers are exclusively recipients of legal services provided by the public sector or SMFs. In addition, like the other customer groups, they conclude contracts all the time: from buying bread at the bakery, to the purchase of real estate.

The demand for LegalTech software diverges largely between the four customer groups:

- Market size: While consumers show slightly lower demand for LegalTech software (most consumer matters are largely settled in their favour, which is why disputes and the need for contractual regulation are less frequent vs B2B context), law firms, enterprises, and public authorities have a significant market for legal services, indicating a corresponding high demand for LegalTech software.

- Actual need: Large law firms have been successful in maintaining their hourly rate business model, which may disincentivize them from investing in efficiency-enhancing software. Although factors like changing work patterns (e.g., unwillingness of younger generations to pull all-nighters), talent competition, and client demands for efficiency are driving the adoption of LegalTech in large law firms, they still lag a bit behind other customer groups due to the lack of intrinsic incentives.

- Perceived need and tech propensity: The main issue here is the perceived need of the public sector. Both users and especially decision-makers are less open to software than in the other three groups.

In conclusion, we see the demand for LegalTech software rank highest among enterprises (all sizes) and SMFs, followed by large law firms, the public sector, and consumers.

Now, let’s examine the ease of sales in relation to the profile of these customer groups:

- International homogeneity: Large law firms, enterprises, and consumers exhibit high global homogeneity within their respective groups. However, the use of LegalTech software in the public sector and SMFs is more influenced by national location and legal framework.

- Big tickets, big hurdles: Selling to heavyweight customers like the public sector, large law firms, and enterprises appears advantageous due to fewer customers needed to generate sufficient revenue. However, early-stage start-ups face significant hurdles, including long sales cycles, lack of track record, insufficient staff, and the need for security certifications. SMEs, SMFs, and consumers offer better opportunities for early-stage start-ups.

- Product-led growth: Product-led growth is particularly successful with SMEs and consumers, as they often lack legal expertise within their organizations. Offering software that allows legal laypeople from these groups to handle their legal needs “self-service” presents a distinct advantage. Large enterprises, law firms, and the public sector, however, face obstacles in adopting product-led growth due to procurement hurdles, legal requirements for confidentiality and data security, and data protection concerns.

To sum it up, we see SMEs and consumers in first place when it comes to simplicity of sales of LegalTech software. A bit surprising, SMFs are in second place. Due to their strict procurement due diligence, the public sector, large enterprises and large law firms are the most challenging customer groups when it comes to ease of sales.

All things considered, it is fair to say that SMEs seem to be the sweet spot for LegalTech start-ups.

The stack: A composite of solutions seeing strong uptake while awaiting re-bundling

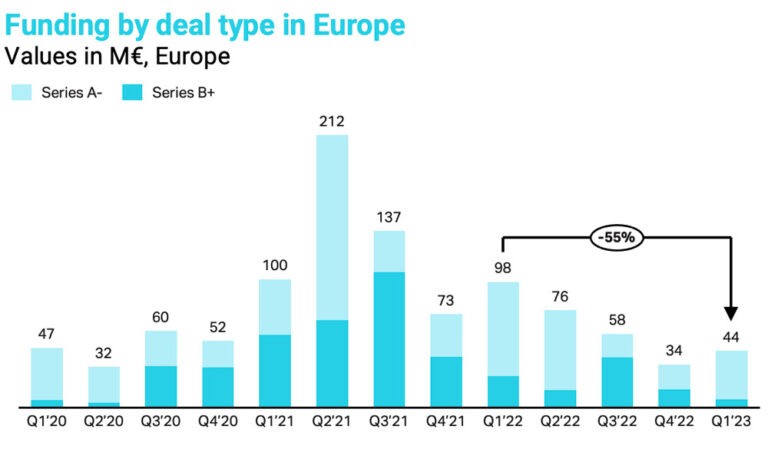

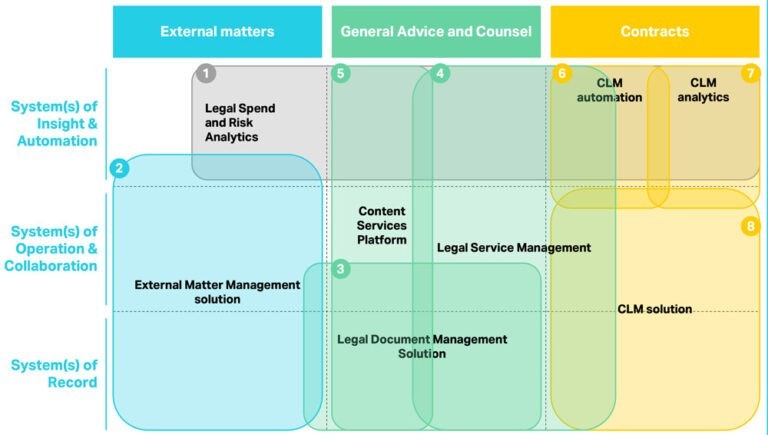

According to Gartner’s definition, the LegalTech stack encompasses a range of up to eight partially overlapping types of solutions (as illustrated in Figure 2). It is crucial to recognize that different customer segments exhibit varying reliance on specific components within this stack. For example, enterprises’ legal departments often prioritize Contract Lifecycle Management (CLM) solutions, while law firms typically require a comprehensive suite covering various aspects of the stack.

Figure 2 – Overview of LegalTech stack and solutions mapping (non-exhaustive)

Note: The list of companies is non-exhaustive; also, companies tend to operate across more than one vertical – our selection of examples is based on our understanding of the company’s main proposition

Source: Gartner (2022), BPI analysis

Irrespective of the customer segments targeted, we have identified three significant trends shaping the evolution of the LegalTech stack, which contribute to our enthusiasm for the space:

- Customers’ Uptake. Historically, law firms and in-house legal departments have been conservative in adopting automation (especially compared to other functions). This translated into little digitization in the space, with thus meaningful inefficiencies associated with legal processes still today and significant value creation potential stemming from the use of tech. However, the pandemic and its aftermath acted as a catalyst for change. On one hand, the pandemic increased legal workloads for already thinly staffed legal firms and departments. On the other hand, the subsequent macroeconomic downturn placed significant pressure on businesses to contain costs, including within the legal sphere. In response, decision-makers are increasingly turning to automation to boost workforce productivity. Gartner estimates a threefold increase in legal departments’ technology budget allocation from around 4% to approximately 12% between 2020 and 2025.

- Re-bundling. Presently, the LegalTech stack remains fragmented, and despite significant M&A activity, no single vendor can provide the full range of software features required by most organizations. However, as customers adopt a more strategic approach to LegalTech, they become more sophisticated buyers, recognizing the value that a unified platform can bring. Although this trend is still in its early stages (Gartner estimates that by 2025, large organizations will still require relationships with four or more LegalTech vendors), it presents a substantial opportunity for software providers in the space. An all-in-one solution would enhance the stickiness of their offerings and enable higher average contract value (ACV).

- GenAI disruption: Among the developments in the LegalTech stack, the most thrilling is the emergence of GenAI. This significant advancement warrants a dedicated section in our subsequent paragraph.

The role of AI: Fast paced innovation driving significant opportunities

At the start of the year, we highlighted the emergence of GenAI as the next big wave of digital innovation (you can read here part 1 of our 4-part series on the topic).

Within the realm of LegalTech, we anticipate substantial disruption to stem from this platform shift. Already today, GenAI possesses the ability to process and generate content (in particular text-based) that is indistinguishable from human output. Large Language Models (LLMs) trained on massive corpora of text, including legal documents, are the most advanced generative AI models and are showing strong performance in the legal domain. GPT-4 passed the LSAT and the Uniform Bar Exam with flying colours.

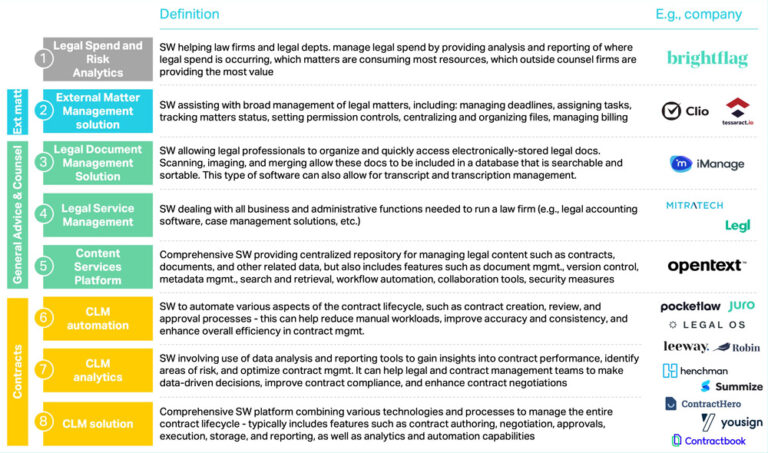

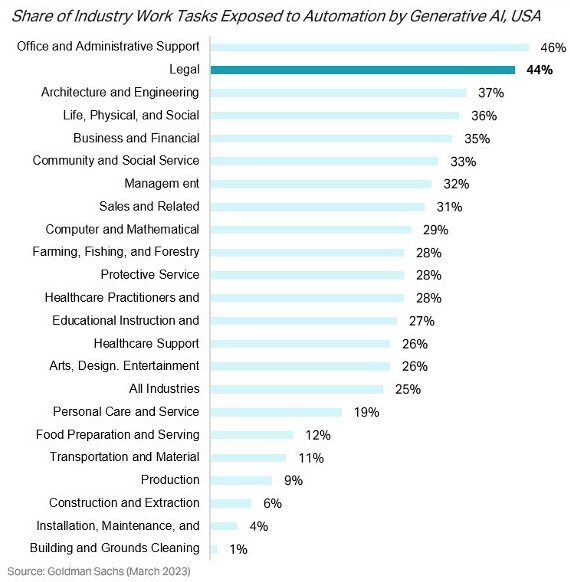

This is not that surprising considering the prevalence of text-based knowledge tasks which characterize the legal industry. According to a Q1’23 study conducted by Goldman Sachs, 44% of work activities within the legal field in the US are exposed to automation by GenAI (see Figure 3). An example of such potentially automated task include document review, or the formulation of compliance related actions (including the provisioning of arguments and scenarios for and against actions in unclear cases).

Figure 3 – Share of industry employment by relative exposure to automation by AI

Source: Goldman Sachs (2023)

The emergence of a new Gen-AI-enabled automation stack, particularly adept at handling repetitive tasks involving the processing of large volumes of text, has the potential to free up valuable time for legal professionals (which can then be redirected to higher value add activities).

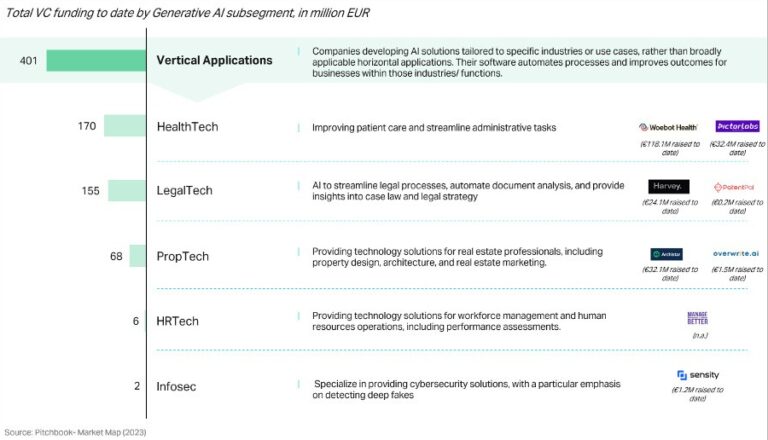

Startups focused on increasing the productivity of legal professionals, like the US-based Harvey or Henchman from Belgium, are already attracting significant interest from Venture Capitalists. According to Pitchbook, LegalTech sands as the second most funded technology vertical amongst the vertical applications built on top of the GenAI platform (see Figure 4).

Figure 4 – Total VC funding in Gen AI Vertical Applications (as of 31.5.2023, in M€)

Source: Pitchbook (2023)

Amidst the excitement surrounding the theoretical potential of applying LLMs to time-consuming legal tasks (such as document review, precedents searching, and contract drafting), caution is warranted regarding the limitations of these models, including e.g., hallucinations and embedded biases. If not implemented and managed properly, these solutions could produce outputs which are inaccurate if not wrong; hence, the implementation of AI software in the realm of Legal matters should be carefully planned and controlled.

We are still in the early stages of this wave of innovation and the GenAI platform is only just being built. The bulk of the funding is still flowing into the platform and infrastructure layers of the Gen AI stack (read more here). Yet, we perceive the innovation on the application layer to be right behind the corner.

Conclusions

Burda Principal Investments is dedicated to offering long-term growth capital to rapidly expanding digital technology companies, with a specific focus on platform, marketplace, and SaaS models.

The Legal Tech Colab is a hub for technology-driven and scalable LegalTech start-ups. The Legal Tech Colab was founded by UnternehmerTUM, TUM Venture Labs and the Bavarian Ministry of Justice in the belief that start-ups with innovative technologies and business models are needed to drive the digitalisation of the legal industry.

As highlighted in this post, we share strong enthusiasm for the LegalTech space. We are particularly interested in connecting with companies that are leveraging the power of AI to enhance their solutions, and that demonstrate efficient customer acquisition strategies.

We hope you found this article interesting, and if you would like to further explore our perspectives or introduce your own company, we invite you to reach out to us directly by contacting the authors Francesco, Friedrich, Stefan and Charlotte.

Thank you for reading, and we look forward to engaging with you!

In this blog post, we present our perspectives on the LegalTech landscape, with a primary focus on companies that leverage technology to enhance and optimize legal processes. Although we recognize the advancements in RegTech as well, we will cover them in a future blog post.