Deep dive: Why we’re investing in the engines of circularity, not just its narrative

1. Why we are interested in circularity, and why now

Waste is still expensive. Supply chains are still fragile. Materials are still finite. In this context, companies are discovering that reducing waste and reusing inputs isn’t just good PR, it’s good business.

This urgency has given rise to the idea of a circular economy: moving beyond the traditional “take–make–dispose” model to one where resources are kept in use as long as possible through reuse, repair, and regeneration. This approach is not only better for the environment but directly addresses some of the most pressing business realities of today.

While some sustainability narratives have cooled under shifting political winds and regulatory rollback, circular business models continue to scale quietly, driven not only by activism, but by economics. In fact, 87% of U.S. firms say they are maintaining or increasing sustainability budgets in 2025, with 65% viewing supply chain sustainability as critical for long-term competitiveness1. The data backs it up: global-scale supply disruptions now occur every 1.4 years, costing up to 10% of product value2.

Goldman Sachs argues that implementing circular solutions isn’t just theoretical upside and projects that the global circular economy will add $4.5 trillion to economic output by 2030 and up to $25 trillion by 20503. These estimates reflect a fundamental shift: building business models that decouple growth from finite resources and succeed because they are economically sound as well as sustainable.

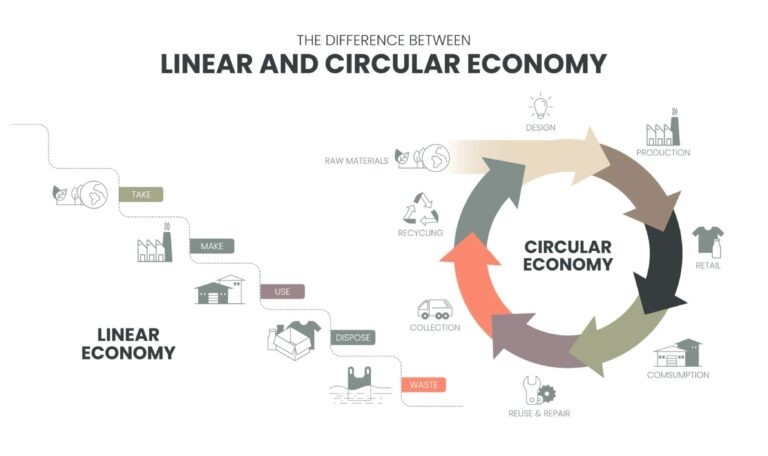

In a linear economy, value creation is tied to a one-way flow of resources that depletes inputs and generates large volumes of waste, often from materials that could still hold value. A circular model instead designs loops that keep materials circulating, reducing dependency on virgin inputs and building resilience (see Figure 1).

Figure 1 – Visualising the circular economy:

Unlike the linear model of take-make-dispose, circular systems are designed to keep resources in use through reuse, repair, and regeneration.

2. Why circularity is good for business

Circular startups don’t have to be “mission-led” prototypes only. Circular business models have matured into commercially robust, tech-enabled businesses with scalable infrastructure, recurring revenues, and clear paths to profitability. Many no longer rely on “green premiums” or regulation to make the model work as they compete on product, efficiency, and economics. Circularity delivers measurable business benefits across several key dimensions:

- Profitability and cost efficiency: Recent studies show that circular business models can deliver 15–20% topline growth and 10–15% material cost savings, with margins comparable to traditional linear models. They lower reliance on volatile raw material markets and fostering local, flexible supply chains.4

- Supply chain resilience: Companies with mature circular strategies report greater resilience and faster recovery from disruptions.4

- Business performance: Companies adopting circularity see improved customer loyalty, access to new markets, and a stronger competitive position. Executives increasingly view circularity as essential for future growth and industry leadership.5

Circular models thrive independently of the sustainability cycle. Whether it’s resale marketplaces, food waste SaaS, or platforms for bio-based inputs, these models are winning because they make operational sense and add sustainability benefits on top.

3. What circularity means for investors

At Burda Principal Investments (BPI), we back scalable, digital-first companies, and have consistently believed that strong economics and circular principles are not mutually exclusive.

While we see compelling opportunities across the entire circular ecosystem, we’ve observed that platform-driven models offer unique advantages for venture-scale growth: they aggregate fragmented supply chains, create network effects, and scale without heavy infrastructure requirements.

Our platform-focused circular portfolio illustrates this thesis in action:

Vinted has become Europe’s leading second-hand fashion platform, with a multi-billion-euro valuation built on transaction fees from peer-to-peer clothing sales. The circular model, extending garment lifecycles, creates a massive TAM while the platform model ensures defensibility through network effects and data.

Buycycle is building the global marketplace for premium bicycles, turning the fragmented used bike market into a liquid, efficient platform. By solving authentication, logistics, and trust issues through technology, they’re creating a scalable business while maximizing asset utilization.

Carsome has become Southeast Asia’s largest used car platform, digitizing the entire value chain from inspection to financing. Their success demonstrates how platforms can transform traditionally inefficient circular markets into high-margin, scalable businesses.

Revibe operates a B2B platform for electronics remarketing, helping enterprises monetize their retired IT assets while ensuring proper data security. They’ve turned corporate waste streams into recurring revenue through workflow integration and compliance automation.

These companies share the same DNA: strong product-market fit, platform economics, and the ability to turn resource efficiency into competitive advantage. They win on superior customer experience and unit economics, not sustainability marketing.

4. Six key circularity models

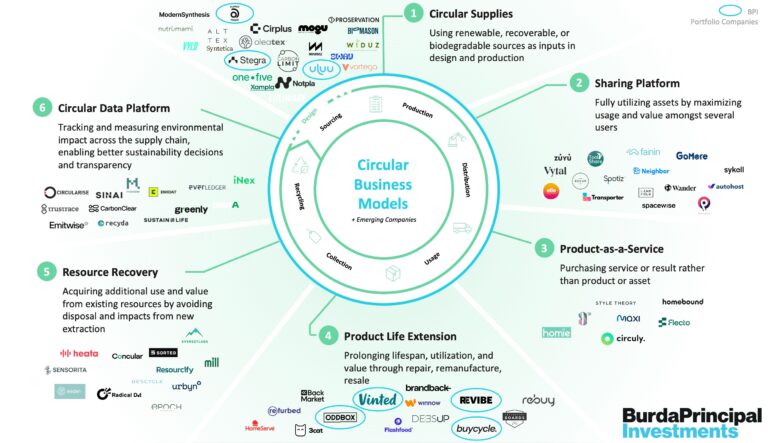

There are six business models that commonly underpin circularity along the value chain. The startup map in Figure 2 shows these models with examples of high-growth startups building momentum across industries:

Figure 2 – Mapping circular business models:

The market map shows the six business models in circularity, with examples of emerging companies in each category.

Circularity touches a range of business models, from re-commerce and reuse to regenerative inputs and waste optimisation. Not all models are equally scalable or VC-compatible. At BPI, we concentrate on those where technology enables scale, defensibility, and strong economics.

5. Where BPI fits in

Following our DNA, we’re particularly drawn to platforms and marketplaces that make circularity scalable. It’s not just the mission that convinces us but the combination of purpose and a strong, scalable model. That’s why we focus on the following core traits:

- Platform dynamics: Marketplaces or platforms that build defensibility through data, network effects, or workflow integration.

- Digital leverage: Models where technology unlocks scalability, especially in complex or previously offline processes.

- Recurring by design: Models that are subscription-based, usage-based, or service-driven.

- Operational efficiency: Tech to manage what used to require heavy infrastructure (e.g., resale, refurbishment, or recovery).

The companies we’ve backed, from Vinted to Buycycle to Revibe, span diverse verticals but share this same foundation. What makes circularity investable for us is when platforms are built with structural defensibility from day one, whether through data, network effects, or workflow integration. We look for tech leverage: models where software unlocks scalability in categories that were previously offline or operationally fragmented. And above all, we care about economic logic: businesses that win on margin, cost structure, and customer experience.

We believe the most compelling opportunities in circularity will come from those who rethink familiar categories through a platform lens and execute with technology at the core.

1 ESG News (July 2025): EcoVadis: 87% of U.S. Companies Boost Sustainability Budgets as ESG Debate Intensifies https://esgnews.com/ecovadis-87-of-u-s-companies-boost-sustainability-budgets-as-esg-debate-intensifies/

2Allianz, Agora Strategy & TUM (October 2024): The Business Case for a Circular Economy https://www.circular-republic.org/ce-business-case-whitepaper/

3 Goldman Sachs (May 2022): The Evolution Towards a Circular Economy https://www.goldmansachs.com/intelligence/pages/gs-research/gs-sustain-circular-economy/report.pdf

4WEF (January 2025): Circular Transformation of Industries: Unlocking Economic Value https://reports.weforum.org/docs/WEF_Circular_Transformation_of_Industries_2025.pdf & Bain (April 2025) https://www.bain.com/insights/circular-business-models-unlock-new-profit-and-growth/

5The Economist Intelligence Unit (2021): The Business Cost of Supply Chain Disruption https://www.international-logistics-group.com/wp-content/uploads/2023/02/the-business-costs-of-supply-chain-disruption.pdf

6. Looking ahead

Circularity is not just a sustainability trend, it is becoming part of the core infrastructure for how industries grow and compete. As resource constraints intensify and technology unlocks new platform models, we believe the strongest opportunities will come from founders who combine strong economics with scalable circular solutions. These companies won’t just adapt to the future, they will define it. If you’re a founder building in this space and recognise your company in these models, we’d love to hear from you.