Consumer credit for the underserved in Southeast Asia, beginning in the Philippines

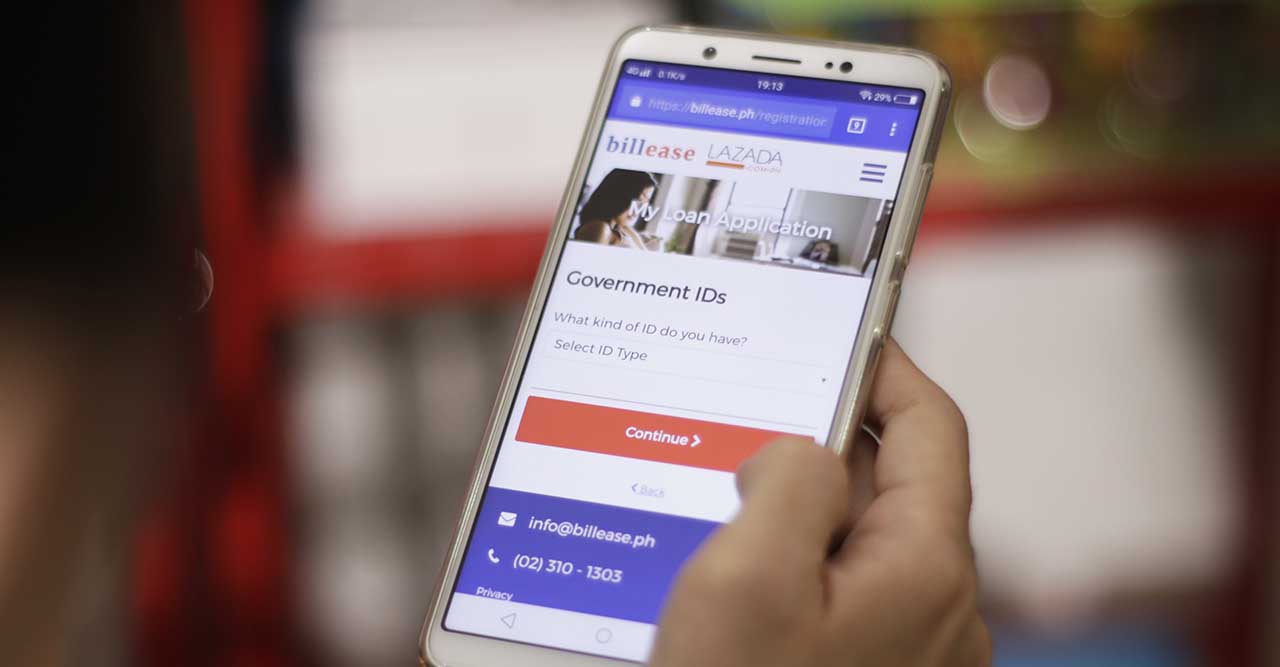

BillEase is a fast-growing, profitable digital consumer platform offering a portfolio of credit products, including buy-now-pay-later (BNPL) and digital wallet loans. With over 1,000 merchants onboard its platform, BillEase is the leading consumer finance platform in the Philippines today. The company was founded by the trio of Georg Steiger, Huyen Nguyen and Ritche Weekun.

At BPI, we look to invest in businesses with strong unit economics, stellar teams and best-in-class products. Looking back at the consumer credit space in Southeast Asia over the last 5+ years, while it was often easy to find businesses with a fast-growing loan book, finding one that knew how to manage risk consistently was much more elusive. When we first met BillEase, we saw a business that was not just growing quickly but also profitably because of their strong credit discipline. With its proprietary credit models and cross-sell approach, BillEase has generated significant long-term value from its repeat customers, and we believe there is a very large group of such customers in the region today whom BillEase can serve. As its first market, consumer credit in the Philippines remains massively underserved today with retail credit-to-GDP ratio at <10% and credit card penetration at just 2%.

Importantly, our participation in the Series B round is not just an investment into BillEase, but the co-founders Georg, Huyen and Ritche. While they are first-time founders, the diverse trio have worked together previously at McKinsey in the region, and each bring significant domain expertise from their previous roles. We are delighted to partner them and look forward to seeing the impact they can make in the Philippines and beyond. Having already leveraged our network to bring on Centauri Fund (MDI Ventures) as a co-investor for the Series B, we hope to do more of the same in future and share our learnings from looking at credit businesses in multiple geographies over the last 5+ years.

Georg Steiger, CEO and co-founder, said: “We found a great partner in BPI as they share our conviction on the massive opportunity to serve the fast-growing emerging middle class in ASEAN and in the Philippines in particular and take a long-term perspective.”