From the consumerization of SaaS to the consumerization of GTM: The final frontier of tech adoption in Europe?

Structural factors beg the question: how will we continue to achieve growth in Europe?

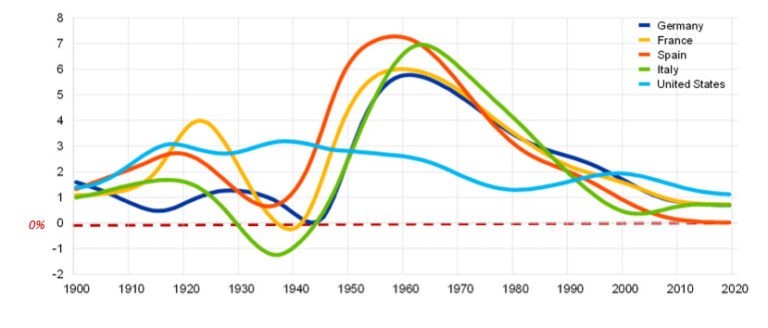

Labour productivity growth in the euro area has been declining for decades and is trending towards 0%, with negligible productivity growth since the financial crisis1 :

Figure 1 – Trends in productivity growth, 1900-2020

Source: published as part of ECB Economic Bulletin, Issue 7/2021

In addition, there is a consistent US-Europe productivity gap (Figure 1), a key driver of which is the United States’ historically superior ability to create and adopt new technologies2.

Add to the above structural economic factors: (1) deteriorating labour shortages across the economy due to both an aging population and The Great Resignation, and (2) the fact Europe benefits from already deep capital markets and a high level of development: Go-forward marginal gains for economic growth will become increasingly difficult to achieve.

We are by no means the first to acknowledge these challenges, but it is important to frame the pressing macro question: how will we continue to achieve growth in Europe?

Significant economic research supports the argument that the dynamics of euro area growth are driven by intra-sector developments. More specifically, where firms invest in productivity-enhancing activities3 that can drive both top-line growth (e.g., GTM enablement, à la our investment in Modjo) and profit (intelligent process/workflow automators supporting greater efficiency).

Addressing the adoption paradox: the consumerisation of SaaS

In addition to the above factors, broader technological developments also offer room for optimism:

- Massive migration to cloud enables enterprise software to be scalably delivered to SMBs, delivering certain key benefits including lower initial investment; high elasticity; no legacy infrastructure to maintain, and auto-updates.

- AI empowering development of more useful application layer products than ever before (a topic on which our colleague Friedrich has recently posted extensively, first in “The Third Wave” series here),

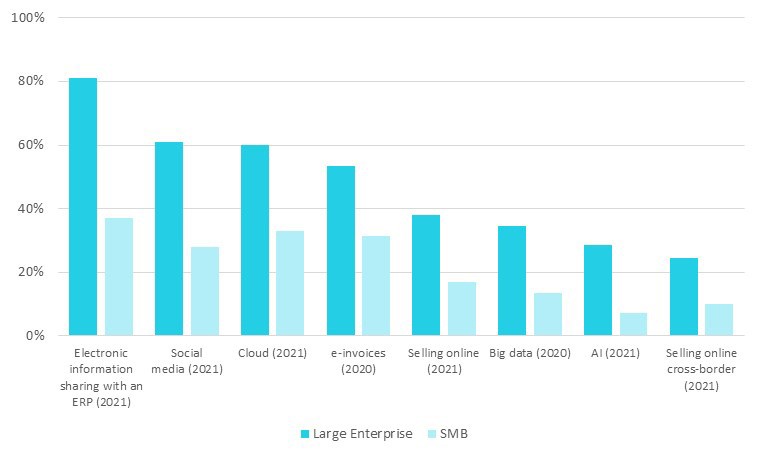

However, despite an overall positive trend, the penetration of many software tools across European SMBs remains surprisingly low4 (Figure 2), further contextualised by the fact only 54% of Europeans aged between 16-74 possess at least basic digital skills.

Figure 2 – Adoption of digital technologies (% enterprise), 2020, 2021

Source: Eurostat, European Union survey on ICT usage and e-commerce in enterprises

What can be done to address this?

Education, upskilling, and reskilling are naturally areas for massive potential in terms of driving long-term adoption of technology.

In addition, as an investor with a strong consumer DNA, we are fascinated by the impact of a trend towards consumerisation of B2B in general, and B2SMB SaaS in particular. The best technologies are generally easy to use, and focusing on this can significantly reduce barriers to adoption. B2SMB SaaS is following many key B2C trends, including intuitive UX with self-serve enablement, humanized language, personalized content, and gamification5. Such developments can reduce the distinction between the technologies we use at work vs. in our personal lives, particularly given many can now be accessed via smartphones. Through aligning the experience of workplace technologies with those we as consumers already use daily, the “a-ha!” moment can come sooner, with several outcomes detailed below that are attractive from our investment perspective.

However even with a solution leveraging the above developments, cracking the GTM strategy remains crucial to facilitate an efficient adoption engine.

Cracking the GTM: Consumerization of GTM driving Product-Led-Growth (PLG)

As a reminder, PLG is a GTM strategy that places end-users front and centre in the product and customer journey. The aim is to design and deliver products that end users start operating independently and intuitively – how many salespeople did you engage with as you started using Zoom, Calendly or Slack? If executed well, this approach accelerates time-to-value (TTV) and encourages customers through a cycle of acquisition, engagement, monetization, and expansion.

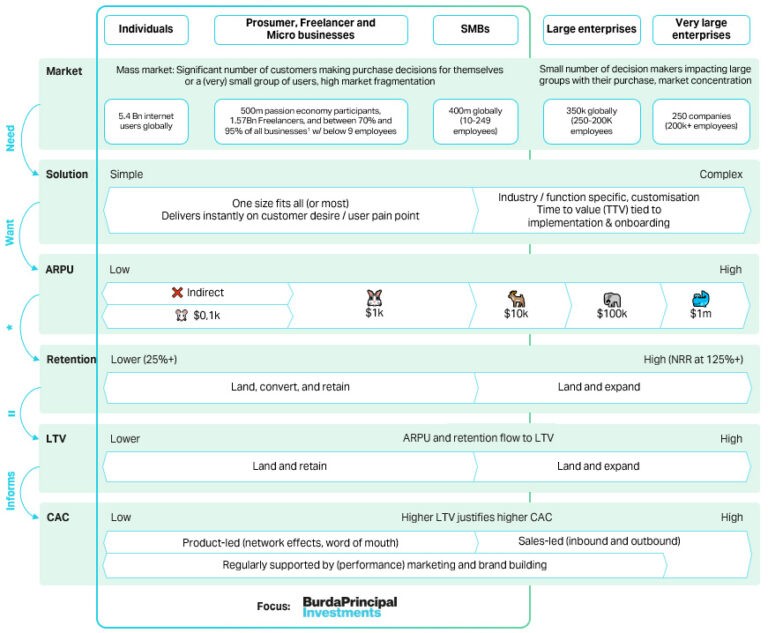

With the help of the below framework, it becomes clear why we believe that products for professional users outside of large enterprises are closer to consumer behaviour and hence require companies servicing them to adjust their product and acquisition strategy, which in turn will lead to optimise for different unit economics compared to sales-led SaaS. In a nutshell: Servicing mass markets requires easy to use, simple products which deliver on the desired outcome instantly. While prices are lower, churn is higher, leading to lower overall LTV and different acquisitions strategies compared to large enterprises.

At BPI we have a strong DNA in investing and partnering with consumer digital companies that work hard to build scalable funnels centred around a killer product. As highlighted by this framework, we see many similarities between the economic and analytical characteristics of these consumer businesses and those in the Prosumer/Freelancer and B2SMB segments that succeed in cracking a PLG motion. Word-of-mouth adoption virality can be achieved with an intuitive product offering and short TTV combined with sustained investment in community, online resource, and brand. Within a company this can take your product from single user to team or even company-wide usage. This also often flows through to larger and more distributed addressable markets.

PLG is not a panacea and is clearly not the appropriate GTM strategy for all companies. However, a proliferation of new products has made it harder to achieve growth and thereby reduced the effectiveness of the traditional funnel. Hiring, training and retention challenges mean it also remains difficult to effectively scale a sales team.

A final note on sales: PLG does not spell the end! Once a user or set of users within a business start adopt a product on a frequent basis, this creates a ‘Product-Qualified-Lead’: salespeople can focus on championing the full functionality of their product to leads who are already further down the funnel. This enhances the efficiency of sales and encourages higher success rates with less time wasted on cold leads.

1UK specific Office of National Statistics references in Financial Times, 9 November 2023

2 Brynjolfsson, E. and McAfee, A., “The Second Machine Age: Work, Progress, and Prosperity in a Time of Brilliant Technologies”, WW Norton & Company, 2014

3 Europa, Key factors behind productivity trends in euro area countries

4 Eurostat, European Union survey on ICT usage and e-commerce in enterprises

5 Vendavo

Conclusions

We are actively investing in Productivity and PLG and having recently refreshed our macro thinking on this sector, we wanted to share our thoughts in this forum. We hope you enjoyed this read and – if you would like to discuss our thoughts or introduce your company – please reach out to us at investments@burda.com or by directly contacting Will.