The Rise of Space Tech: Why Now is the Time to Pay Attention

From celestial navigation and advanced optics to solar panels and even Velcro, space has long been a driver of technological and economic progress. Today, the space economy stands at approximately $600 billion and is projected to triple, reaching $1.8 trillion within the next decade. With a forecasted 9% annual growth-rate—roughly double the global GDP growth—space is becoming comparable to semiconductors, an industry valued at $600 billion in 2021, and expected to expand 6-8% annually into the 2030s. Like semiconductors, space technology will increasingly integrate into everyday life, powering applications with connectivity and geospatial intelligence capabilities, similar to how GPS already supports last-mile delivery and ride-hailing apps with location data.

Historically, investments in the space industry have centred on infrastructure and initial downstream markets like satellite TV and radio. Over the next decade, the share of space economy captured by traditional hardware and service providers is expected to gradually decrease to the benefit of entrants that are developing new applications based on space data. By 2035, applications building on communications, positioning, navigation and timing (PNT), and Earth observation (EO) capabilities are projected to grow 1.5x faster than traditional backbone technologies, becoming the main drivers of growth and ultimately accounting for 60% of a $1.8 trillion space economy.

At BPI, we actively seek scalable platform models that arise from technological breakthroughs and shifting consumer trends, drawing on our experience with category leaders like Etsy, Vinted, Carsome, and NordVPN. We believe that a new wave of innovation will emerge from space data-based applications, and we are closely following developments in this rapidly evolving market.

In this Perspectives article, we share our insights and hypotheses on the space industry. We begin with a look at its historical evolution and the key forces driving commercialisation and investment. We then highlight some of the early success stories shaping the market, offering illustrative examples. Finally, we outline the trends and opportunities we find most exciting.

The Evolution of Space from a Government-Led Industry into a Commercial Market

The Origins of Space Technology

Thirty years after Robert Goddard launched the first liquid-fuelled rocket in the 1920s—a self-funded project that initially drew little attention—the post-World War II tensions between the US and the Soviet Union ignited the first major wave of investment and innovation in space technology. Between the 1950s and 1970s, both governments achieved critical milestones, driving an era of rapid technological advancement, that laid the groundwork for today’s thriving commercial space industry.

First image of Earth taken from space in 1959. Source: NASA

In 1957, the Soviet Union launched Sputnik, the first satellite to reach orbit. A year later, the US followed by launching the world’s first experimental communications satellite, which famously broadcast a pre-recorded Christmas message from President Eisenhower. The US launched another satellite the following year, capturing humanity’s first pictures of Earth from space. By 1969, the Apollo 11 mission made history when two US astronauts became the first humans to set foot on the Moon, with a landing watched by an estimated 650 million people worldwide.

At the same time, commercial space activity began to emerge, with government-backed partnerships like COMSAT / Intelsat paving the way for commercial satellite communications since the early 1960s.

The 1970s saw continued progress, including the Soviet Union’s launch of the first space station in 1971, a precursor to what would later become the International Space Station. By 1975, Cold War tensions eased, leading to the cooperative Apollo-Soyuz mission.

Since then, what started as an initiative led by governments funding projects of stratospheric costs, increasingly gave way to a large and viable commercial market opportunity. In 2023 the global space economy was estimated to be worth $630 billion, with over $470 billion derived from commercial applications.

The Privatisation of Launch

One of the key enablers for the commercial space industry has been the privatisation of launch services, which eventually led to significant cost reductions. In 1981, NASA launched the Space Shuttle, demonstrating the first reusable trip to orbit. However, the high manufacturing costs and

complex refurbishment process made this program still economically unviable without government support. Legislative changes in the 1980s started to allow private players to enter the market, but competition with government-subsidised launches remained difficult. The 1986 Challenger disaster marked a turning point, prompting the US government to reduce NASA’s role in commercial launches, ultimately retiring the Shuttle program in 2011.

Throughout the late 20th century, private launch providers and satellite manufacturers steadily emerged, coinciding with the early commercialisation of GPS technology. However, the true inflection point came in 2015 when SpaceX’s Falcon 9 rocket achieved the first-ever landing of an orbital-class booster, marking a pivotal moment in the industry’s shift toward commercial viability. In 2017, SpaceX further advanced launch economics by successfully reusing a rocket for the first time.

SpaceX’s innovations dramatically lowered barriers to entry, transforming an industry once dominated by NASA and major defence contractors. This surge in commercial launch availability has substantially decreased costs. For perspective, the cost of launch to Low-Earth orbit (LEO) with the Space Shuttle was around $65,000/kg (inflation-adjusted). Today, a Falcon 9 achieves this at roughly $4,000/kg when flown at maximum capacity. SpaceX’s rideshare offerings and the Falcon Heavy continue to drive prices lower, while their next-generation Starship promises unprecedented affordability—with long-term estimates below $100/kg for LEO missions.

A Boom in Space VC Investments

The democratisation of launch services rapidly attracted venture capital-funded entrepreneurs eager to capitalise on the growing space economy. Following Space X’s first successful commercial launch in 2009, the number of new VC backed space companies funded per year more than tripled—rising from 7 in 2009 to 22 in 2012. During this period, VC funding quadrupled to $193M. Although still modest in scale, this growth hinted at the significant progress to come.

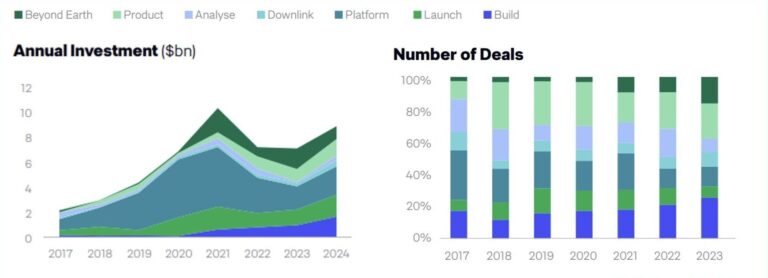

Yearly evolution of VC investment into space tech

Source: Bryce Tech Start-up Space Report 2023, Space X

The sector saw a surge in investment from 2015 onwards, exceeding $6.5 billion annually in 2022 and 2023. In 2024, space startups raised a record $8.6 billion, highlighting sustained momentum in private-sector space innovation.

Over the past decade, the US has maintained its lead in breakthroughs and investment in space tech. However, Europe—and particularly Asia—have started to catch up in recent years. In 2024, Asia surpassed Europe in investment, driven by China, which accounted for 83 out of the 178 deals in the region.

Looking ahead, this trend is expected to continue, particularly with the new US administration as US-China tensions and competition for strategic dominance in space intensify. Europe has also committed to increasing its defence budget to reduce reliance the US. This trend has accelerated in recent months but builds on initiatives such as the €1B NATO Innovation Fund launched in mid-2024.

These developments will inevitably feed into space tech investment, as its technologies are inherently dual use, playing critical roles in intelligence, secure communications, and navigation.

Yearly evolution of VC investment into space tech across regions

Source: Seraphim Ventures Space Index Q4-2024

Translating Space Technology into Economic Value and Profit

VC Investment Evolution Across Categories

With a valuation recently estimated at $350 billion, SpaceX stands out—not only as a leading venture-backed space tech company but also, as one of the most valuable tech startups in the world. Beyond Space X, the overall space tech market continues to see rapid investment growth, rising profits, and evolving business models. In this section we explore some of the most prominent segments and companies that have emerged across these categories.

Platform

- Planet Labs: Founded in 2010, Planet went public via SPAC in 2021 at a $2.8B valuation. As of Q3-24, the company reported $61M in revenue growing steadily at 10-15% YoY. Today, 95% of its revenue is recurring across more than 1,000 customers, addressing initial concerns about intermittent and concentrated market demand. Gross margins have notably improved from 47% to 61%, signalling clear progress towards profitability.

- Spire: Another significant EO player, Spire, went public in 2021 with a valuation of $1.6B. It is projected to achieve $127M revenue in 2024 (+20% YoY) with positive operating cash flow.

- Other private EO companies, such as ICEYE ($500M+ raised) and Capella Space ($300M +raised), have gained substantial traction and funding in this segment.

Separately, space-based connectivity platforms have also driven substantial value creation, with companies building global satellite networks for broadband and direct-to-device communications.

- Starlink: If spun off, Starlink would constitute a significant portion of SpaceX’s valuation.

- OneWeb: Another of the large connectivity players, OneWeb, merged with Eutelsat in 2023 after emerging from bankruptcy in 2020, in a deal valuing the business at $3.4B.

- AST SpaceMobile: AST SpaceMobile reached a $7B market cap in December 2024 after securing key licenses and partnerships, notably with Vodafone. The company went public via SPAC in 2021 at a $1.8B valuation.

Build

Companies that build space infrastructure, including satellites, components, systems, sensors, and control software, more sustainably and at lower costs than incumbents, have been attracting increased VC investment and business momentum in the recent years.

- Rocket Lab: Initially a launch provider, Rocket Lab diversified into space systems manufacturing, generating over 70% of its $436M 2024 revenue from this segment. Public since 2021 at a $4.8B valuation, its market cap exceeded $12B by December 2024.

- Terran Orbital: A less successful but also visible outcome to date in this category is Terran Orbital. Lockheed Martin fully acquired the business in October 2024 in a transaction that valued the business at $450M, following a $1.8 billion SPAC listing in 2021.

- Private businesses like Minospace ($275M raised in 2024), Hadrian ($117M Series B), Q-CTRL ($100M+ Series B), K2 Space ($100M+ Series B), OrbitWorks ($100M Series D), or APEX ($95M Series B) also demonstrated robust investor interest in the past year.

Product & Analyse

While this shift has yet to be fully reflected in funding figures, industry signals—from expert forecasts to early-stage deal flow—point to a growing concentration of value in companies enabling spatial data analysis and developing space-based products for Earth.

- GPS Integration: Early examples of success in the space data-based product categories are ride-hailing and last-mile delivery apps.

- The Climate Corporation: Co-founded by All-In podcast host David Friedberg in 2006, the company pioneered self-serve insurance products for farmers using weather prediction models and was acquired by Monsanto in 2013 for ~$1B. Even back then, Monsanto already recognised a $20B revenue opportunity in services and data products to help farmers optimise field operations.

Planet Labs estimates that only 1% of EO’s potential impact has been captured, emphasising the infancy of EO adoption. With advancements in analytics and AI integration, spatial intelligence is poised for significant growth across diverse sectors including agriculture, insurance, energy, finance, and defence. The same holds true for location data where private companies like Xona Space Systems are developing resilient, next-generation positioning networks that enhance accuracy down to the centimetre level, unlocking new capabilities to leverage for industries like precision agriculture, autonomous transport, industrial automation, supply chain resilience, and defence.

Recap: Key Themes Shaping Our Focus at BPI

1) Infrastructure Costs Continue to Collapse

SpaceX’s breakthroughs have reduced launch costs by over 15x over the past decade. The ambition for Starship is to divide the current cost by at least 40x and bring even more capacity to the market. Satellite manufacturing costs have similarly plummeted—from ~$1 billion for the old large government satellites to ~$100,000 for the average LEO satellite today—and are expected to halve again by 2030. These shifts, alongside growing rideshare capabilities, radically lower entry barriers for anyone seeking space-based data capture.

Evolution in the cost and availability of key space infrastructure

Source: A giant leap for the space industry McKinsey report

2) Exponential Growth in Satellite Coverage & Data Quality

The reduced cost of access has triggered rapid satellite deployment: active satellites surged from 1,500 in 2017 to approximately 13,300 by late 2024. Commercial operators now dominate launches, driving forecasts to 20,000-30,000 satellites by 2030, with some estimates reaching 65,000.

Evolution of the number of active satellites in orbit

Source: Statista

Split of spacecraft launched by operator type during Q1-24

Source: Bryce Tech Q1-24 briefing

Beyond the high-profile mega-constellations of Starlink and OneWeb, smaller remote-sensing satellites have experienced significant growth. High-resolution imagery capture alone has increased more than fivefold since 2011, coupled with technological advancements across optical, SAR, hyperspectral, and thermal sensors. Simultaneously, GPS and broader PNT sensors are also advancing, increasingly driven by the private sector and featuring enhanced accuracy from meters down to centimetres and improved resilience against signal disruptions. The growing abundance and precision in data is set to unlock unprecedented insights across sectors.

Evolution of small sats by application excluding One Web and Starlink

3) Streamlined Data Storage & Delivery

Generating satellite data is just the beginning; efficient storage and rapid distribution are essential. Historically, legacy EO companies struggled with expensive, cumbersome on-premises storage. In recent years the industry has started to shift to cloud solutions, directly downlinking satellite data into cloud infrastructures, which reduces costs, improves access, and accelerates processing. In 2025, onboard space-based computing capabilities are expected to further enhance data processing—transmitting actionable insights rather than vast raw datasets.

Separately, companies like Atlas.co, Arlula, Privateer, Skify, Skywatch, Tilebox, and multiple others, are working from different angles towards streamlining customers’ access to space data. Planet Labs’ Analysis Ready Planetscope (ARPS), which harmonises daily satellite imagery for easier integration to machine-learning workflows, is another example of this trend.

4) AI as an Accelerator of Actionable Insights

Artificial Intelligence plays an important role in scaling EO data analytics as it promises to reduce the complexity and cost of obtaining actionable insights from raw imagery that are accessible to a broader user base. AI-driven analytics will also enable businesses to extract even more value from location-based data, leading to smarter decision-making and greater operational efficiencies.

Companies such as Ask.Earth already simplify EO data consumption, allowing business analysts in large energy and insurance companies to rapidly derive value from existing data bank and proprietary models, without requiring extensive technical expertise or needing to wait for input from R&D teams.

5) Growing Talent Pool

The decreasing costs and complexity of capturing, storing, and distributing satellite data eventually allow software developers across industries to integrate space data insights into products, without needing deep expertise in space tech. This shift enables new companies leveraging space data to focus on building customer-driven, ROI-centric products rather than getting bogged down in space-related complexities. The result: an influx of talent, rapid innovation, and practical, scalable solutions ready to deliver immediate value across industries.

Consider Treefera, a company launched in 2022 that has rapidly gained traction, partnering with major clients like Acciona. Its co-founders Jonathan and Caroline—formerly a Managing Director at JPMorgan and the Chief Customer Officer at UiPath—have built a team of engineers, data scientists, environmental specialists, compliance experts, and go-to-market leaders. Notably, their focus isn’t on satellite expertise, despite their product relying on satellite data to provide critical supply chain insights. This highlights a fundamental shift: whereas earlier space tech companies had to solve complex technical challenges from the ground up, today’s innovators can build directly on existing infrastructure and focus on business strategy. In Treefera’s case, customers don’t just value the accuracy of its insights—they are drawn to its superior marketing and product experience, illustrating how success in space applications increasingly hinges on commercial execution rather than technical breakthroughs alone.

The Inflection Point for Space Applications

Geospatial intelligence is rapidly becoming accessible and valuable across multi-billion sectors like agriculture, insurance, energy, finance, logistics, or defence. We see the space data market reaching an inflection point driven by reduced infrastructure, storage, distribution, and analytics costs.

Looking forward, we are most excited about companies building new data-driven platforms building on enhanced EO and Positioning, Navigation, and Timing (PNT) data insights and unlocking transformative commercial opportunities across these industries.

Conclusion

People consistently misjudge the pace of technological progress. At first, excitement peaks as we envision a wave of transformation. When change doesn’t happen overnight, attention shifts elsewhere—just as compounding breakthroughs quietly gain momentum. Then, almost imperceptibly, the pace accelerates.

The space economy is at this inflection point. What once felt distant is now unfolding at speed, and those who recognise this shift early will be best positioned to capture the opportunities ahead. That’s why we’re paying attention.

We see this article as the starting point for many great conversations about the future of space tech and its applications. If you’d like to connect, or believe your company should be on our radar, reach out to Julian here!