UK consumer surveys: what makes us all tick?

Continuing on with results from our recent consumer survey series, next we look at the area of Finance. The report below gives insights into the fintech space, based on the recent feedback from 2,000 individuals living in the UK. Take a look!

Finance

Over the last few years, we have witnessed a steep rise in the number of retail investors across Europe. During the Covid-19 pandemic, lockdown measures and social restrictions had two impacts that reinforced this trend: firstly, some people were spending less (e.g. travelling less or no longer going on holidays, not eating at restaurants as much) which increased the amount they could save, and secondly some people found that they had more time to discover the best ways to invest their savings. At the same time, easy to use apps and platforms have become increasingly ubiquitous, making personal finance management, saving and investing easier than ever before.

The UK has one of the largest and most active retail investor communities in Europe, if not the most, so we wanted to share some of the key trends we have spotted as we went through our UK survey results:

1. Active management of personal finance is gaining significant importance over time

Over the last few months, people in the UK have been striving to look after their personal finances in a more active way: 27% are more actively managing their finances, 35% are saving more and 19% are investing more. While this pattern existed across all age groups, under 35s are more than twice as likely to be “doing more now” compared with older generations.

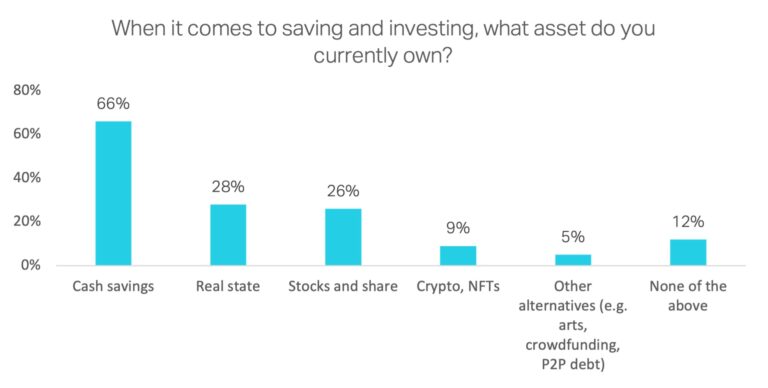

Today, two thirds of the population already have some cash savings, and almost 50% of people report that they are planning to save more in the next few months.

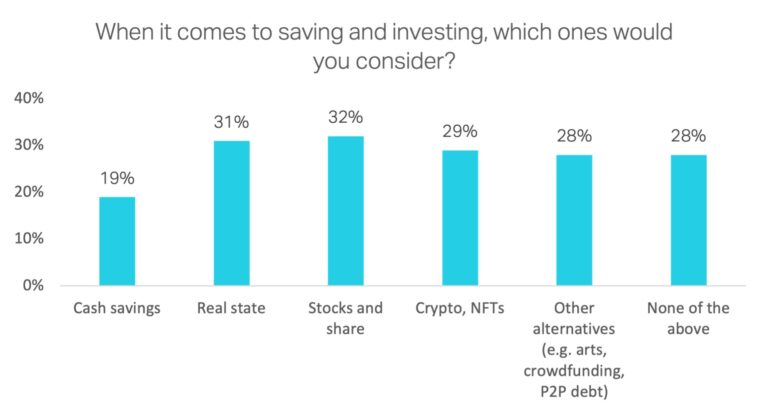

Both older and younger people alike are interested in deploying their savings across a broad spectrum of asset classes in the future, including traditional ones like real estate and stocks and shares, and emerging and digital asset classes such as crypto and NFTs.

Of course, the latter is attracting more attention from younger generations, with 41% of under 35s expressing an interest in crypto and NFTs compared with only 14% of over 55s. So, despite younger generations having less cash savings overall, they are already more actively invested in a wider range of asset classes than older generations. This democratisation of alternative investing is emerging as a key fintech trend for 2022.

We also spotted some underserved consumer groups when it comes to investing, and we are hopeful that some great companies will come along to address these:

👩 Investing is still gender biased – only 27% of women invest beyond having cash saved up, compared with 48% of men

🌳 People living outside of London are less likely to invest – 52% of Londoners have investments beyond cash saved up, compared with 31-40% of people (depending on whether you live in an urban, suburban, or rural area)

2. Fintech in saving and investing have gained significant share from incumbents

With the high variety of consumer fintech apps that we have seen emerge in recent years, it has never been easier to engage with the stock markets, invest in ETFs and manage multiple pensions in one place. Whether you are an active or passive investor, or whether you want to make “real world” or digital investments, there is an app for you and many more.

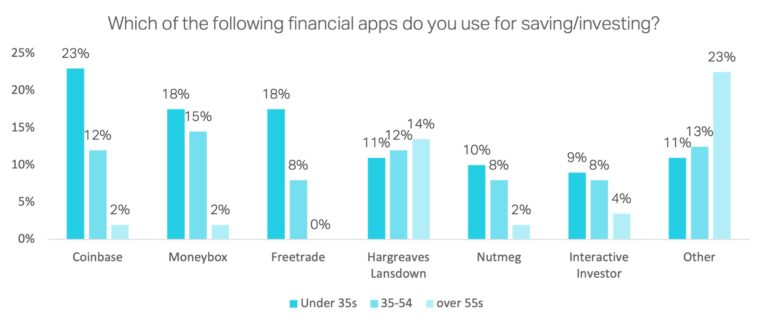

Our survey reveals rapid adoption of these services across the UK population, driven by easy access and great user experience, to the point where the largest new platforms have caught up with legacy players.

The dominance of Coinbase, Moneybox (one of our portfolio companies) and Freetrade in the under 35s compared to Hargreaves Lansdown and other legacy players is significant. Hargreaves Lansdown is used by just under 11% of the age bracket compared to 23% for Coinbase, 18% for Freetrade and 18% for Moneybox. This really highlights how a great user experience combined with innovative products and viral user acquisition have taken the market by storm and converted the younger generation to investing more.

Incumbents such as Hargreaves Lansdown and Interactive Investor are still considered best-in-class by higher income categories, who value their brands and trustworthiness, the ease-of-use of their digital products, as well as their range of investment options and cost competitiveness.

Some of the most popular “other” platforms that people reported using are St James’s Place, Binance, Trading 212, Wealthify and Kraken. Having said that, 6 in 10 people in the UK do not use a savings or investment app. This shows the amount of white space still available for new market entrants to go after.

Conclusions

The increasing rate of saving and time on-hand over the past couple years, combined with higher comfort in managing personal finances online, have created a new cohort of investors, who are seeking returns and engaging deeply in the process. There is significant opportunity for digital products in traditional and alternative asset classes, to continuously improve the user experience, provide a sense of trust that is on par with incumbent brands, and work on assortment through consolidation of investment options. Beyond this, there is also opportunity in reaching underserved groups such as women and non-Londoners.

We look forward to watching, experiencing, and supporting the next generation of fintech founders and their companies scaling up over the coming years in the UK and Europe. If you would like to discuss any of the results of our survey, have a chat about the future of finance, or introduce your company then please reach out to us (investments@burda.com)!