Why We Invested: Buycycle – Building the Global Leader in Premium Sports Resale

At Burda Principal Investments, we’re always searching for next-generation marketplaces that solve structural inefficiencies while delivering exceptional user experiences. Our investment in Buycycle represents exactly this thesis in action – a rapidly scaling platform that’s transformed the fragmented world of premium bike resale into a trusted, global marketplace.

The Market Opportunity: A Billion-Dollar Problem Waiting for a Solution

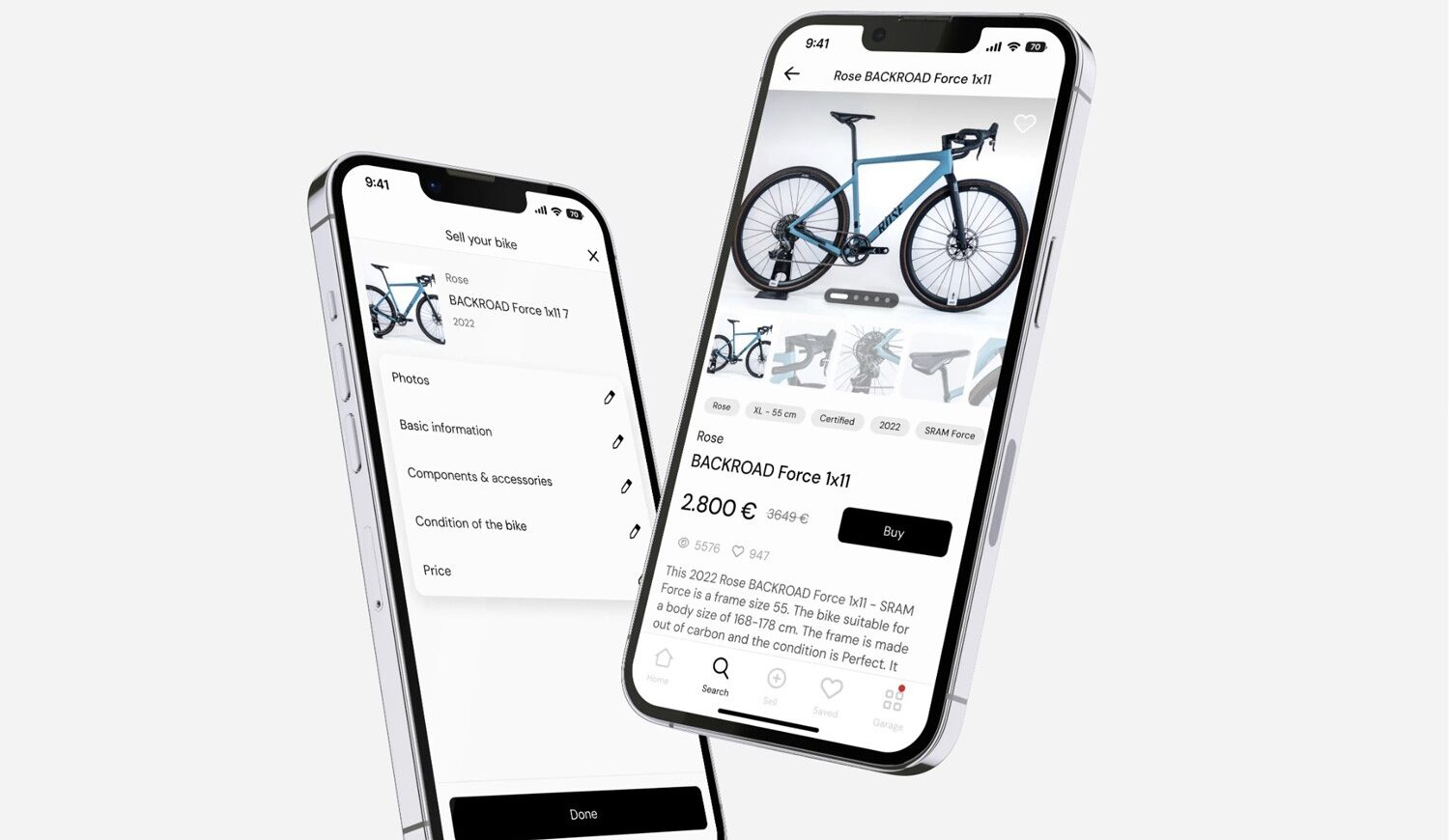

The second-hand bike market has long been plagued by fragmentation and trust issues. High-end cycling enthusiasts – who invest thousands in premium road, gravel, and mountain bikes – have historically relied on unreliable peer-to-peer platforms or local classified ads when buying or selling their equipment. This created significant friction: buyers struggled to find quality bikes and verify their condition, while sellers faced limited reach and complex logistics.

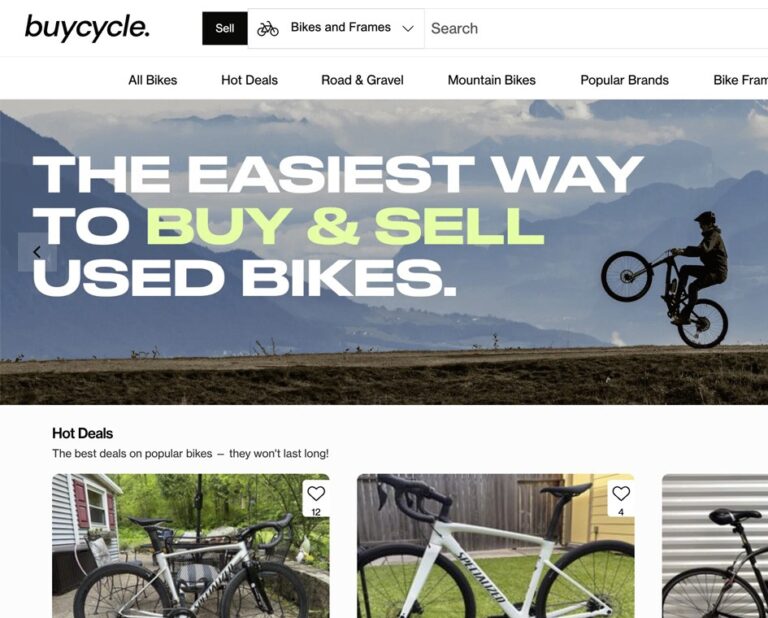

Buycycle identified and solved this structural inefficiency. Founded in 2021 by Theo Golditchuk and Jonas Jäger out of their own frustration with existing options, the company has rapidly established itself as the leading global marketplace for premium bike resale. The numbers speak volumes: scaling to triple-digit million GMV within just three years, while maintaining exceptional customer satisfaction.

What Sets Buycycle Apart: Execution Excellence Meets Market Leadership

Three key factors convinced us that Buycycle represents a generational investment opportunity:

1. A Strong Team Built for Execution

The founders and broader team bring a rare combination of professionalism, relentless drive, and humility to everything they do. As competitive triathletes themselves, Theo and Jonas naturally apply high-performance thinking to business building. This athletic mindset shapes the company culture: despite high growth, they’ve maintained attention to critical details like data security and continuously manage efficiency. This isn’t just about scaling quickly, it’s about scaling intelligently.

2. Dominant Market Position with Winner-Takes-All Dynamics

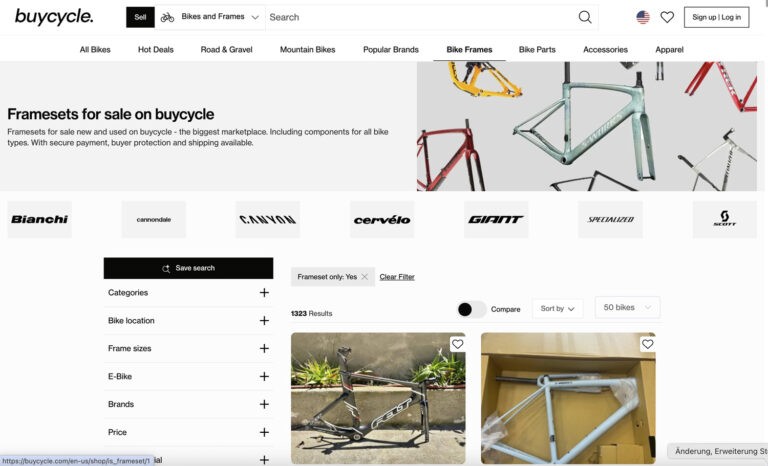

Buycycle has achieved what every marketplace dreams of: clear category leadership in a market with natural network effects. As the leading platform for pre-owned high-performance bicycles across 30+ markets, they’ve created a virtuous cycle where more sellers attract more buyers, and vice versa. In marketplace dynamics, this often translates to winner-takes-all outcomes – and Buycycle is positioned to be that winner.

The platform now lists tens of thousands of high-end bikes, most of them selling quickly. With majority of transactions happening cross-border, they’ve created genuine value for both sides: buyers access wider selection and better prices, while sellers reach a international audience willing to pay premium prices for quality equipment.

3. Sustainable Unit Economics and Capital Efficiency

Despite focusing on global expansion, Buycycle has maintained a disciplined approach to unit economics. The team’s focus on operational efficiency has enabled them to achieve unit profitability while continuing to scale, demonstrating the power of their asset-light marketplace model and sustainable approach to growth.

The Vision: Beyond Bikes to Premium Sports Resale

What excites us most as new investors is Buycycle’s expansion potential. While the used performance bicycle market alone represents over €69 billion in total transaction value across Europe and the US, the company has clear ambitions to become the go-to platform for all pre-owned premium sports goods.

They’ve already begun this journey, successfully launching components and accessories on the platform in October 2024, and are starting to experiment with new sports equipment categories. The roadmap of course also includes expansion into adjacent bike categories – essentially building the “Vinted for premium sports goods.”

This horizontal and vertical expansion strategy transforms Buycycle from a bike marketplace into a comprehensive sports resale platform, dramatically expanding their addressable market while leveraging their core competencies in trust, logistics, and user experience.

Strong Investor-Target Fit

Buycycle fits squarely within our investment thesis and portfolio. Like our successful investments in Vinted, Etsy, and Carsome, this represents a next-generation marketplace solving real structural problems while creating significant value for both buyers and sellers.

Supporting Sustainable Commerce

Beyond the financial opportunity, Buycycle aligns with broader consumer trends toward sustainability and circular consumption. By making it easier, safer, and more transparent to buy and sell premium bikes, they’re extending product lifecycles and reducing waste in the consumer goods sector.

Looking Ahead

The funding will enable Buycycle to accelerate product development, enhance customer experience, and expand into new categories and markets. With their proven execution capability, dominant market position, and clear expansion runway, we’re confident they’ll continue building on their impressive trajectory.

We’re proud to back Theo, Jonas, and the entire Buycycle team as they transform not just how people buy and sell bikes, but how they engage with premium sports equipment more broadly. Our investment reflects BPI’s marketplace thesis on practice – backing a category-defining company with exceptional founders who are solving real problems at global scale.

The ride ahead looks exciting, and we’re thrilled to be part of the journey.

To learn more about Buycycle, visit buycycle.com