First Steps – Impact & ESG at Burda Principal Investments

As part of our commitment at Burda Principal Investments (BPI) to address the impact we have through our internal activities and external investments, we have started a process of measuring and evaluating our social, environmental and sustainable economic practices. Our responsibility in the fight towards global sustainability is to identify and be transparent around the impact we are creating and work to improve this where possible. We will work both internally and in partnership with our portfolio companies in order to achieve this.

Alongside the responsibility we have to measure and improve our impact, there are also multiple benefits in doing so. Other than the positive impact this creates, we are increasingly aware of the positive financial performance granted to businesses that not only comply with ESG (Environmental, Social & Governance) requirements but also build their business models around solving critical world problems (think zebras over unicorns). These practices help to not only mitigate risks but also realise great opportunities and position businesses for future growth, especially in the B2C space.

Our Impact Commitment

- Address the impact we have as a company and be transparent about this impact.

- Engage in a continued process of measurement, evaluation & improvement.

- Look at both the impact of portfolio companies & our own internal impact.

- As a first step gather information about what impact is occurring and identify where positive impact can be scaled & negative externalities are reduced.

Defining Our Position

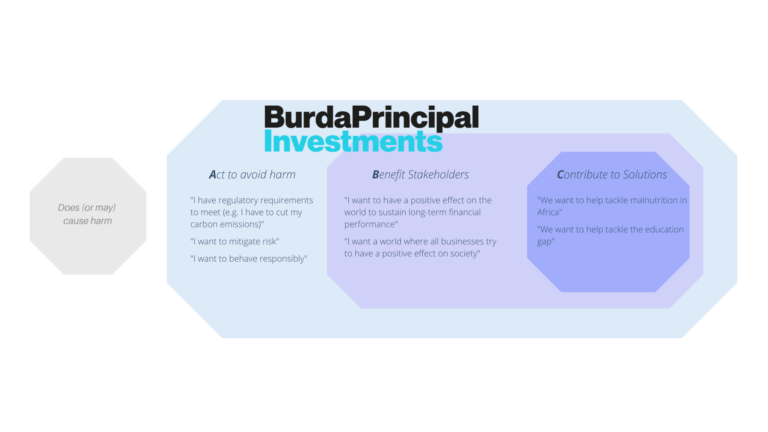

The world of ESG, impact and sustainability is an exciting and fast evolving space but can also be confusing to the untrained eye. We felt it first important to define where we sit within the ecosystem and what key terminology mean to us internally. Closely following the work of industry leaders such as the Impact Measurement Project (IMP), we agree that impact exists on a spectrum. The IMP’s framework below (click graphic below to zoom in) helps to visualise the diversity of impact approaches in the investment sector, ranging from ESG strategies (such as positive or negative screening of investments) to more solutions-oriented strategies (i.e. focused on tackling specific world problems) and everything in between. We see our current position at BPI as somewhere between points A & B. We invest in many purpose-driven companies who are building solutions to some of the worlds big environmental and social problemsand while we are not ourselves a dedicated impact investor, we see our commitment (as outlined above) to avoid doing harm and work towards improving practices that benefit a range of different stakeholders. In order to capture the full spectrum of this impact in our measurement activities, we refer to both ‘Impact & ESG’ in our strategy.

Defining Our Approach

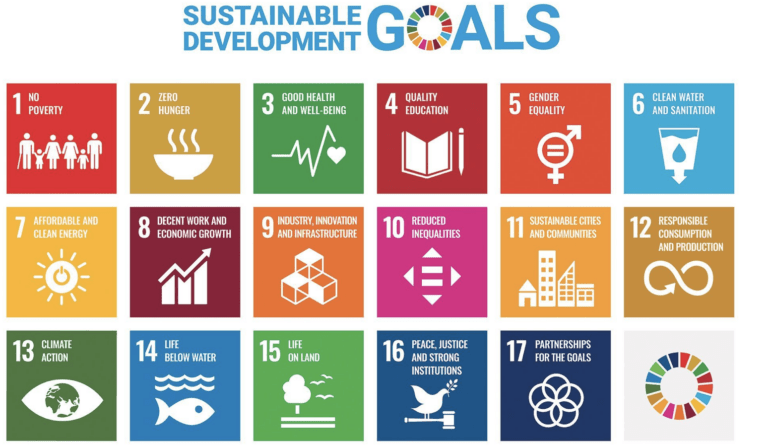

As a guiding framework for our first Impact & ESG review exercise we chose to align ourselves with the UN’s Sustainable Development Goals (SDGs). These 17 focus areas are among the most widely adopted reference systems when discussing impact, due to their clear & comprehensive scope. At BPI, we have chosen a subset of 6 of these to focus on, which we believe are most relevant & meaningful to our internal business & the external reach we have through our investments. These are: Health & Wellbeing, Education, Gender Equality, Sustainable Economic Growth, Reduced Inequalities and Responsible Consumption & Production. Observing the sub-indicators of the SDGs, the focus on developing markets is clear. In order to relate these indicators to our business activities across many different markets, we have also mapped them to other leading ESG frameworks and metrics systems including the Global Reporting Initiative (GRI), the International Integrated Reporting Council (IIRC) and the Sustainability Accounting Standards Board (SASB).

Although we are yet to reach a global standard for impact & ESG, we continue to follow the promising work of the industry leaders mentioned above and those closer to home in the Venture Capital sector. We commit to engage and collaborate with these players to help make these global standards a reality, with the knowledge that speaking a common language will help to spread the reach of impact further.

2020 review – The First Step

In our first review of Impact & ESG we wanted to gain a greater understanding around the current status quo for BPI internally and externally and form a baseline to build on over time. In order to do this we conducted a survey alongside our portfolio companies involving several chosen metrics for each SDG area taken from the SDG indicators & corresponding ESG frameworks mentioned above.

The results from our first Impact & ESG review for 2020 can be found HERE. We were greatly impressed with the initiatives already underway and the commitment by our portfolio companies to continuously improve.

Some key highlights from our first review were:

81% of our portfolio companies provide various programme to support the wellbeing of their employees (i.e. sports, lifestyle and mental health).

75% detail Learning & Development policies involving budgets and target for internal education & trainings.

53% have strong female representation (50%+) amongst employees and/or management.

38% support low income families, developing countries or the provision of financial services for financial inclusion through internal and external activities

50% have Diversity and Inclusion (D&I) & equal opportunity practices in place within the organisation

31% are measuring and offsetting/reducing their carbon footprint (some are even net positive!)

For us, these first steps set a promising foundation and we look forward to continue to learn and develop here in the months and years to come.

by Clare McCartney Beer

Chief Operating Officer

Burda Principal Investments